The SPX closed lower by 3% today.

I’ve looked at drops of 5% or more in depth in the last few months and found there to be a tendency for a short-term bounce following such steep drops.

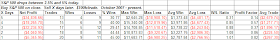

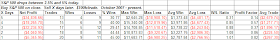

Tonight I decided to see how drops between 2.5% and 5% have fared since the beginning of the bear market.

In these cases further downside was more common. 84% of instances closed below the trigger price at some point in the next 3 days.

I`ve taken a look at SP declines much like you have done here, except I`ve divided them into several subgroups. Seems like our conclusions are similar.

ReplyDeletehttp://tallenestale.blogspot.com/2009/02/store-fall-pa-s-500.html

Thanks Wangas. Good stuff.

ReplyDelete