The most common type of post here on the blog is one where I’ll show a setup along with a statistics table examining how the market has performed based on similar setups in the past. On the blog, most studies are examined independently. In the Subscriber Letter I’ll take a holistic approach to viewing the studies. The tool I use to do this is

the Quantifiable Edges Aggregator.

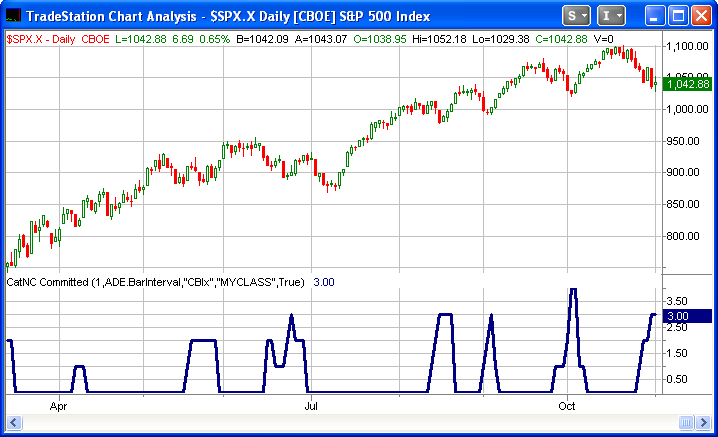

The Aggregator takes a measurement each evening that estimates what all of the currently active studies are projecting over the next few days. This number is plotted and used on the Aggregator chart, which is published each night in the Subscriber Letter. Along with the estimates the Aggregator chart also shows how the market has performed relative to expectations over the last few days. This is helpful in establishing whether the market is overbought or oversold. I have claimed substantial upside edges typically exist when expectations are positive and the market is oversold versus recent expectations. Also, substantial downside edges typically exist when expectations are negative and the market is overbought versus recent expectations.

While many of the index-oriented trade ideas in the Subscriber Letter were based on the Aggregator chart, I’d never quantified the Aggregator nor used it as a mechanical entry…until recently.

Now that we have nearly two years of historical values I decided it was time to take the concepts above and show exactly how a mechanical strategy based on the Aggregator would have performed. The results were even better than I expected.

Since 2/25/08 (about 20 months), the reinvested return (not inclusive of commissions, slippage, or interest on cash) of trading the SPX based on the Aggregator System signals would have been 106.34%. The system has struggled more recently and is currently experiencing a 3.94% drawdown. Over the full time period it has been invested a little over 60% of the time, with the remaining 40% of the time spent in cash. Both long and short trades have contributed fairly equally.

In my mind, the success of the Aggregator as a tool and as a predictive indicator has cemented the value of historical quantitative research. It demonstrates that incorporating quantifiable edges does indeed provide a quantifiable edge!

More details about the Aggregator System may be found on the

systems page of the Quantifiable Edges website. Details include an 11-page working document that reviews the results, discusses recent performance and evaluates alternate entry and exit techniques. Additionally there is a spreadsheet available to all trial users that shows summary statistics, an equity curve and details of every single trigger since 2/25/08 (when the Subscriber Letter began).

Gold level subscribers are able to download the full history of the Aggregator and Differential values in a .csv file. This allows them to more easily integrate the tool into existing strategies or to build their own strategies based on it.

Anyone who wishes to trial the Quantifiable Edges subscriber services may do by clicking here. If you have previously trialed or subscribed to Quantifiable Edges, but would like the opportunity to trial again and see details of the Aggregator System, feel free to drop an email to support @ quantifiableedges.com (no spaces) and you will be set up with a new 1-week trial.