The declining VIX has been a hot topic lately. Adam at the

Daily Options Report had an interesting and (as you’ll see below) accurate comment the other day about overbought/oversold VIX readings: “

Also, oversold VIX does not provide as good an indicator as overbought. Outright fear tends to lead to big turns, outright disinterest can just linger.”

The most common technique I see discussed for trading based on the VIX is viewing it in relation to its 10-day moving average. This was originally made popular by Larry Connors. Many traders will throw moving average envelopes around the VIX, wait for a stretch and then trade the S&P 500 based on a mean reversion. A relatively high VIX means market participants are fearful and the market should be bought while a relatively low VIX is a sign of complacency and a short signal. With the VIX continually dropping, traders have been on alert for a VIX stretched below its 10-ma to try and short. But is that really a good time to be short?

Over the last 10 years, owning the S&P 500 when the VIX was more than 10% below its 10-day moving average was significantly more profitable on average than owning it when it wasn’t. Let me repeat that.

Owning the S&P 500 when the VIX was more than 10% below its 10-day moving average was significantly more profitable on average than owning it when it wasn’t. To illustrate I ran a study:

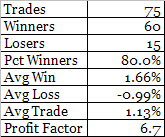

Short the VIX on a cross of the lower 10% envelope of the 10-day moving average. Cover when it moved back above this envelope. From 5/98 until now there were 87 such trades. The average lasted just over 3 days. The S&P actually GAINED 91.09 points in the 272 days that this was in effect. That is an average of about 0.33 points per day. In the other 2,379 days the market only managed to gain 184.22 points – about 0.08 points per day. In other words, the market actually performed over 4 times BETTER when the VIX was stretched more than 10% below its 10-day moving average. Also, when this VIX-stretch was active the S&P made nearly 1/3 of its total gains in only 9% of the time.

So is the whole low VIX = complacency thing a fallacy? Not completely. Many times it will

lead to a selloff. Here’s a system which demonstrates that. Again, last 10-years is the time period. 1)

Short the S&P 500 when the VIX crosses from below to above the lower 10% envelope but remains below its 10-day moving average on a closing basis. 2) Exit the trade when the VIX closes above its 10-day moving average. Here you would have had 58 trades. The average trade would have made you about 7 S&P points and the total system gain, or S&P points lost, over the time period is 403.17 – a very substantial number.

To sum up - just because the VIX is “low” doesn’t mean the market is about to fall. In fact a good portion (about 1/3) of the S&P gains over the last 10 years have come under these conditions. When the VIX moves out of complacent territory and back towards its mean, then the market is susceptible to a decline.

I’ll look at high VIX readings an upcoming post.

For more VIX discussion, check out what

VIX and MORE had to say earlier this week.