On average SPY has lost 0.25% in the last 15 minutes of trading. And if you just look at the losers, the average loss was 0.345%. Last year was the 1 big up year (excitement over avoiding the Fiscal Cliff?). If you are a daytrader with a long position, this might be a good day to close up shop 15 minutes early…

Tuesday, December 31, 2013

Should You Quit Trading Early Today?

The table below is from a study I showed in last night’s subscriber letter. It shows how SPY has performed every year, during the last 15 minutes of trading for the year.

On average SPY has lost 0.25% in the last 15 minutes of trading. And if you just look at the losers, the average loss was 0.345%. Last year was the 1 big up year (excitement over avoiding the Fiscal Cliff?). If you are a daytrader with a long position, this might be a good day to close up shop 15 minutes early…

On average SPY has lost 0.25% in the last 15 minutes of trading. And if you just look at the losers, the average loss was 0.345%. Last year was the 1 big up year (excitement over avoiding the Fiscal Cliff?). If you are a daytrader with a long position, this might be a good day to close up shop 15 minutes early…

Friday, December 27, 2013

VXO Is Suggesting An Immediate Pullback - Or None At All

Thursday we again saw the VIX and VXO close well below their recent mean. Such stretches suggest a collapse in fear among investors. The study below was last seen in the 10/21/13 subscriber letter. It looks for stretches of 15% or more that have persisted for three days.

Based on the stats table there appears to be a downside inclination. I find the note at the bottom of the study to be especially interesting. Nearly every case has experienced an almost immediate pullback, but those that didn't went without pulling back for a long time.

Based on the stats table there appears to be a downside inclination. I find the note at the bottom of the study to be especially interesting. Nearly every case has experienced an almost immediate pullback, but those that didn't went without pulling back for a long time.

Friday, December 20, 2013

'Twas 3 Nights Before Christmas (updated Nasdaq version)

I’ve been posting and updating the “Twas 3 Nights Before Christmas” study on the blog here since 2008. The study will kick in at today’s close. This year I will again show the Nasdaq version of the study. While all the major indices have performed well during this period, the Nasdaq Composite stands out as the big winner.

The stats in this table are strong across the board, and the note at the bottom shows reliability that has been nothing short of incredible. Traders may want to keep this one in mind over the next couple of weeks.

The stats in this table are strong across the board, and the note at the bottom shows reliability that has been nothing short of incredible. Traders may want to keep this one in mind over the next couple of weeks.

Monday, December 16, 2013

The Most Wonderful Tiiiiime of the Yeeeeeeaaaaaarrrrrrr!

Over several time horizons op-ex week in December has been the most bullish week of the year for the SPX. The positive seasonality actually has persisted for up to 3 weeks. Below are the results since SPX options began trading in 1984. I have shown this table every year since 2008, and have updated the results again this year.

The stats here are extremely strong. Have a happy (and most likely bullish) December Opex Week!

The stats here are extremely strong. Have a happy (and most likely bullish) December Opex Week!

Monday, December 9, 2013

Learn Some Fed-Based Edges at the Festival of Traders

I'm going to be participating the The Festival of Traders this month for the 1st time. It is a 2-day event that features presentations from 8 traders.

I'll be speaking about Fed-based edges in regards to numerous time-frames (from short-term to long-term, and in between). My talk is scheduled for 5:30pm EST on Tuesday, Dec 10th. Time not convenient? No worries! Register using this link and recordings of all speakers will be automatically sent to you at the conclusion of the Festival.

And beyond my talk, the line-up looks very impressive. In fact, on Wednesday 2 of the 7 guys I placed on my list of "Real Deal Traders" will be talking - Scott Andrews and Dave Landry.

This is a Quantifiable Edge I suggest you take advantage of :)

Again, the link to register is available here. (Nothing but an email address required.)

I'll be speaking about Fed-based edges in regards to numerous time-frames (from short-term to long-term, and in between). My talk is scheduled for 5:30pm EST on Tuesday, Dec 10th. Time not convenient? No worries! Register using this link and recordings of all speakers will be automatically sent to you at the conclusion of the Festival.

And beyond my talk, the line-up looks very impressive. In fact, on Wednesday 2 of the 7 guys I placed on my list of "Real Deal Traders" will be talking - Scott Andrews and Dave Landry.

This is a Quantifiable Edge I suggest you take advantage of :)

Again, the link to register is available here. (Nothing but an email address required.)

Friday, December 6, 2013

Recent Employment Day Tendencies

The employment report is due to be released Friday morning. News there could certainly send the market in either direction. But anxiety about the employment report has largely been unfounded over the last year and a half. The table below was published in Wednesday night’s subscriber letter. It looks at how the VIX, XIV and SPX have all performed on employment days since 7/1/12.

These 17 instances have shown a strong propensity for the VIX to drop, and XIV and SPX to rally. We’ll see how it works out today, but the recent tendency has been bullish on employment days.

These 17 instances have shown a strong propensity for the VIX to drop, and XIV and SPX to rally. We’ll see how it works out today, but the recent tendency has been bullish on employment days.

Labels:

Employment Days,

Quantitative Study,

seasonality,

VIX

Thursday, December 5, 2013

VIX Closes Up For The 7th Day In A Row While SPY Is In An Uptrend

One notable bit of action is that Wednesday marked the 7th day in a row that the VIX has risen. That is a very unusual streak. I decided to look back at all other times the VIX had risen for 7 days in a row while SPY was above its 200ma. Below are results of SPY assuming a 3-day holding period.

Instances are low, but so far the returns are overwhelmingly bullish. Very little drawdown compared to both the run-up and the average trade. This appears to be worth some consideration.

Instances are low, but so far the returns are overwhelmingly bullish. Very little drawdown compared to both the run-up and the average trade. This appears to be worth some consideration.

Wednesday, December 4, 2013

A Compelling 3-day Pullback Study

Tuesday marked the 3rd close lower in a row for SPY. Three-day pullbacks will often trigger a few bullish studies. The one below is the one I found most interesting. It was featured in last night's subscriber letter. It looked at other times that SPY had a 3-day pullback from a 50-day high, and that pullback was deep enough to put it below the 10ma, but not deep enough to see it at a 10-day closing low. I have updated the stats table below.

Under these circumstances, it appears bounces have been both reliable and powerful.

Under these circumstances, it appears bounces have been both reliable and powerful.

Wednesday, November 27, 2013

A Long Term Look At Thanksgiving Wednesday

Thanksgiving has shown some pretty consistent seasonality over the years. On Monday I showed a table breaking returns down by day of the week. Both the Wednesday before and the Friday after have exhibited bullish tendencies while the Monday after has been somewhat bearish. Today I decided to show a profit curve that represents simply owning the SPX from Tuesday's close through Wednesday's close.

Appears to be an impressive looking upslope. Happy Thanksgiving!

Appears to be an impressive looking upslope. Happy Thanksgiving!

Monday, November 25, 2013

An Updated Look At Thanksgiving Week Tendencies

Historically Thanksgiving week has shown some very strong tendencies. The last time I showed the table below on the blog was in 2010. I decided to update it this year.

Monday and Tuesday before Thanksgiving don’t seem to carry a sizable edge. Monday’s total return was actually negative until 2008 when it posted a gain of over 6%. Wednesday and Friday surrounding Thanksgiving have shown strong upside tendencies and the Monday after has shown a downside edge.

Monday and Tuesday before Thanksgiving don’t seem to carry a sizable edge. Monday’s total return was actually negative until 2008 when it posted a gain of over 6%. Wednesday and Friday surrounding Thanksgiving have shown strong upside tendencies and the Monday after has shown a downside edge.

Thursday, November 14, 2013

Back to Back Outside Days for QQQ

QQQ made both a lower low and a higher high on Wednesday versus the day before. That is often referred to as an “outside day”. Outside days are not terribly unusual. What is unusual is that it happened fort eh 2nd day in a row. In the past the simple fact that range has expanded for the last 2 days has led to a short-term rally. I last showed this in the 8/22/12 blog. Below is an updated results table.

The numbers all appear impressive. I also produced an equity curve that assumed a 1-day holding period.

The persistent upslope is impressive and it serves to confirm the upside edge.

The numbers all appear impressive. I also produced an equity curve that assumed a 1-day holding period.

The persistent upslope is impressive and it serves to confirm the upside edge.

Friday, November 8, 2013

The TICK TomOscillator & How It Is Suggesting A Bounce

This morning @PsychTrader was kind enough to mention Quantifiable Edges and the TICK TomOscillator on StockTwits.

The blog post he linked to was this one from May 13, 2011.

In light of this I thought I would share the study that was discussed in the subscriber letter last night that @PsychTrader referred to as the long signal. It utilized the standard TICK TomOscillator (as Tom McClellan designed it). The standard reading was -245.42 at the close yesterday. This is extremely low. In fact, there have only been 3 lower readings in the past year. The study looked at readings below -200 that coincided with a 5-day low in in SPX and an SPX close above its 200-day moving average. Here is the results table:

There has been a strong propensity for the market to bounce over the next 2-3 days. Despite the negative reaction to the jobs report, traders may want to keep this in mind.

The blog post he linked to was this one from May 13, 2011.

In light of this I thought I would share the study that was discussed in the subscriber letter last night that @PsychTrader referred to as the long signal. It utilized the standard TICK TomOscillator (as Tom McClellan designed it). The standard reading was -245.42 at the close yesterday. This is extremely low. In fact, there have only been 3 lower readings in the past year. The study looked at readings below -200 that coincided with a 5-day low in in SPX and an SPX close above its 200-day moving average. Here is the results table:

There has been a strong propensity for the market to bounce over the next 2-3 days. Despite the negative reaction to the jobs report, traders may want to keep this in mind.

Friday, November 1, 2013

SPY Registers 1st 5-day Low In A While - Now What?

Thursday the SPY managed to close at a 5-day low after 16 days without doing so. This triggered the study below, which I last showed on the blog May 25th.

Results here suggest a moderate upside edge. As I have said before, persistent uptrends normally wither before they die. They rarely just turn on a dime. It appears unlikely that SPY will be faced with a lot more selling before it manages to bounce.

Results here suggest a moderate upside edge. As I have said before, persistent uptrends normally wither before they die. They rarely just turn on a dime. It appears unlikely that SPY will be faced with a lot more selling before it manages to bounce.

Tuesday, October 29, 2013

Fed Days And Intermediate-Term Highs

Tomorrow

is a Fed Day. As I have discussed many times, Fed Days generally carry an

upside tendency. But this tendency is greatly impacted by certain variables. A

large collection of these variables may be found here on the blog under the “Fed Day”label.

And many more may be found in the “Quantifiable Edges Guide to Fed Days”.

One

variable I showed about a year ago was whether the market was already at an

intermediate-term high. There is a decent chance the market closes at a new

high today so I've decided to update that study.

First,

let’s take a look at SPX performance on Fed Days when the SPX has NOT closed at

a 20-day high the day before.

That’s nearly

32 years of bullishness.

But now

let’s see performance at times when the SPX did close at a 20-day

high the day before.

No

consistency and no pronounced edge in this sample of 41 instances.

Traders looking to play

for a short-term Fed Day bump should perhaps be hoping the SPX does not close

at a new high today.

Also, for related research with regards to the overnight, be sure to check out this post at OvernightEdges.

Also, for related research with regards to the overnight, be sure to check out this post at OvernightEdges.

Monday, October 28, 2013

SPY Extended To The Point That Often Leads To A Pullback

SPY has now gone 12 days without closing below its 5ma. The study below is one I’ve shown a few times over the years. It looks at other instances in which SPY has traded above the 5ma for at least 2 weeks and is now closing at a 10-day high. All results are updated.

In the past this setup has commonly been followed by a short-term pullback. The downside edge doesn't last long, though. It seems to pretty much play itself out over the first 2 days. It is not an overwhelming edge, but it is still worth noting that SPY has been short-term extended for a while and the normal course of action at this point is a little pullback.

In the past this setup has commonly been followed by a short-term pullback. The downside edge doesn't last long, though. It seems to pretty much play itself out over the first 2 days. It is not an overwhelming edge, but it is still worth noting that SPY has been short-term extended for a while and the normal course of action at this point is a little pullback.

Friday, October 25, 2013

What's Going to Happen in Vegas

The International Traders Expo is going to be at Caesar's Palace from November 20-23, 2013.

I've been to this expo a few other times and have really enjoyed it. I'm pleased to announce I'll be back this year and giving a presentation on Friday, November 22 at 2pm.

The topic of my presentation will be "Quantifiable Edges for Short-Term Trading". I'll be covering a lot of my favorite studies and setups.

I hope to get the opportunity to meet many readers and subscribers at the Expo.

I've been to this expo a few other times and have really enjoyed it. I'm pleased to announce I'll be back this year and giving a presentation on Friday, November 22 at 2pm.

The topic of my presentation will be "Quantifiable Edges for Short-Term Trading". I'll be covering a lot of my favorite studies and setups.

I hope to get the opportunity to meet many readers and subscribers at the Expo.

Wednesday, October 23, 2013

Another VIX Study With A Short-Term Warning

The VIX most often will trade opposite SPX. But Tuesday it rose along with it. That’s not too unusual for one day, but the same thing also happened Monday. This triggered the study below which was last seen in the 5/16/13 subscriber letter. I discussed the results in some detail in last night’s letter, and have shown the profit curve below assuming a 1-day holding period.

Overall the results appear to suggest a moderate downside edge for Wednesday.

Overall the results appear to suggest a moderate downside edge for Wednesday.

Monday, October 21, 2013

Uh-Oh, Low VXO (Revisted)

Both the VIX and VXO (which is the old calculation for the VIX) closed well below their 10-day average for the 3rd day in a row on Friday. This action in VXO triggered a study that I last discussed here on the blog on January 7, 2013. The January instance followed the fiscal cliff deal at the end of last year, which was similar to the recent shutdown/debt ceiling debate. The study looks for stretches of 15% or more below the 10ma that have persisted for three days.

Based on the stats table there appears to be a downside inclination. I find the note at the bottom of the study to be especially interesting. Nearly every case has experienced an almost immediate pullback, but those that didn't went without pulling back for a long time.

Based on the stats table there appears to be a downside inclination. I find the note at the bottom of the study to be especially interesting. Nearly every case has experienced an almost immediate pullback, but those that didn't went without pulling back for a long time.

Tuesday, October 15, 2013

SPY Results After Days Like Monday With Strong Gap Reversals To 10-Day Highs

Many traders view reversals like Monday as a positive. The fact that the market overcame a gap down and was able to close in the black and near its highs is interpreted as a sign of strength. I’ve looked at days similar to this in the past and found that most often they are actually followed by short-term market weakness. Below is a study that looks at situations like Monday’s. It assumes a 1-day hold.

Eleven of 15 instances have closed down the next day. Of course that is a bit of a small sample size, and another concern is the fact that it has been over 4 years since the last instance. Still, I think the study is worth some consideration.

Eleven of 15 instances have closed down the next day. Of course that is a bit of a small sample size, and another concern is the fact that it has been over 4 years since the last instance. Still, I think the study is worth some consideration.

Sunday, October 13, 2013

An Updated Look At A Columbus Day Edge

While the stock market is open on Monday, banks, schools, and the bond market are closed. (Government offices, too, but they are closed all the time these days.) In past years with the bond market closed, the stock market has done quite well on Columbus Day. Of course the most famous Columbus Day rally was in 2008 when the market gained over 11% after having crashed the week before. The last few years I showed that positive momentum leading up to Columbus Day has generally led to a positive Columbus Day. Columbus Day has been celebrated on the 2nd Monday of October since 1971. Below is an updated version of the Columbus Day study.

I’ve circled some of the more impressive stats here. With 74% of trades profitable and winners twice the size of losers, risk/reward has been very favorable. The note below the stats table is also worth considering, and with big overnight drop in the futures could come into play once again.

Tuesday, October 8, 2013

VIX Spikes To New Highs

It is notable that the VIX spiked up 16% on Monday and closed at the highest level since June. In the past when it has closed at a high level on a strong move there has been a tendency for the SPX to bounce over the next few days. This can be seen in the study below from the 5/15/12 blog. (Stats are updated.)

The numbers appear compelling. Below is a profit curve using a 2-day hold.

This study has been persistently bullish for a long time and certainly appears worth consideration.

The numbers appear compelling. Below is a profit curve using a 2-day hold.

This study has been persistently bullish for a long time and certainly appears worth consideration.

Monday, September 30, 2013

Big Gaps Down on Mondays

I took a look this morning to see how the market has typically reacted when faced with a big gap down on a Monday morning. Results below examine all gaps of 0.75% or more and measure the performance from the 9:30 open to the 4pm close.

Numbers here look a bit poor. I also ran a profit curve.

The curve shows that the downside edge appears to have lessened over time. I also decided to break it down by the long-term trend. These next 2 charts show results when below and then above the 200ma.

It appears the real damage has been done during long-term downtrends. During uptrends, big gaps down on Monday's have been neither reliably bullish nor reliably bearish. Additional evidence would be needed for me to initiate a new position.

Wednesday, September 25, 2013

We-versal Wednesday?

Going into the day yesterday we had a Turnaround Tuesday setup. When the market is down 3 days in a row going into a Tuesday, it has had a strong tendency to bounce. Of course there have been instances over the years where it hasn’t. And yesterday was one. When it doesn’t rise on Tuesday what does that mean for Wednesday and beyond? Though it has appeared in the Subscriber Letter numerous times over the years, I have not shown the test below on the blog since August of 2012. It answers that "Wednesday & beyond" question.

Results here have been very strong over a long period. It seems the Turnaround Tuesday failure has typically been a temporary setback.

Results here have been very strong over a long period. It seems the Turnaround Tuesday failure has typically been a temporary setback.

Sunday, September 22, 2013

The Weakest Week Is Here Again

From a seasonality standpoint, there isn’t a more reliable time of the year to have a pullback than this upcoming week. Since 1961 (and over most every time period) the week following the 3rd Friday in September has produced the most bearish results of any week. In the 9/24/12 blog I showed a chart of SPX performance during this week since 1961. I have updated that chart below.

As you can see the bearish tendency has been pretty consistent over the last 52 years. There was a stretch in the late 80’s where there was a series of mild up years. Since 1990 it has been pretty much all downhill, and last year was no exception.

As you can see the bearish tendency has been pretty consistent over the last 52 years. There was a stretch in the late 80’s where there was a series of mild up years. Since 1990 it has been pretty much all downhill, and last year was no exception.

Thursday, September 19, 2013

An Updated Look At Fed Rallies To New Long-Term Highs

In “The Quantifiable Edges Guide to Fed Days” I discussed Fed Days that close at new highs. The basic finding was that when the market closed at a short-term high on a Fed Day, then it was likely to pull back over the next few days. But when it closed at a long-term high, then the rally was likely to continue. Below is a study from the Guide that last appeared in the 9/14/12 blog.

This suggests further upside is likely over the next 1-2 weeks.

This suggests further upside is likely over the next 1-2 weeks.

Wednesday, September 18, 2013

An Unfilled Up Gap / Inside Day Pattern

Today’s movement will largely be due to the market’s reaction to the Fed. But I thought I would share a study that triggered yesterday that would perhaps have a bit more influence on a non-news day. It looks at days like Tuesday where the market gaps higher, never fills, and moves higher from open to close without making a higher high.

Implications here appear somewhat bearish, with most of the damage occurring on day 1. Traders may want to keep this pattern in mind for the future.

Implications here appear somewhat bearish, with most of the damage occurring on day 1. Traders may want to keep this pattern in mind for the future.

Tuesday, September 17, 2013

When VIX Rises On Monday As SPX Hits A Short-Term High

I am seeing a mix of short-term evidence at the moment. Having not shown anything bearish lately, I decided to share the study below, which triggered at the close on Monday and hints of a downside edge. It looks at times during long-term uptrends that the VIX closes up on the first day of the week while the SPX is closing at a 10-day high. Most of the time the VIX and SPX will trade in opposite directions. The VIX has a natural tendency to fall on Fridays and rise on Mondays. Due to this, Monday is the most common day of the week to see VIX rise in conjunction with SPX. This study appeared in the Quantifinder yesterday afternoon, and I have updated all stats below.

Results here certainly appear to suggest a day or two of weakness.

Of course Wednesday is a Fed Day, which brings about additional considerations. Ahead of this, traders may want to review many of the Quantifiable Edges Fed Day edges using the Fed Study label. Or for a more complete collection of Fed Day studies, check out The Quantifiable Edges Guide to Fed Days.

Results here certainly appear to suggest a day or two of weakness.

Of course Wednesday is a Fed Day, which brings about additional considerations. Ahead of this, traders may want to review many of the Quantifiable Edges Fed Day edges using the Fed Study label. Or for a more complete collection of Fed Day studies, check out The Quantifiable Edges Guide to Fed Days.

Friday, September 13, 2013

A Pullback After At Least 5 Up Days

Thursday’s moderately lower close triggered the following study that examines pullbacks after multi-day runs higher.

Initially there appears to be a moderate inclination for a move higher. Once you get out 9-10 days the upside edge appears solid. The idea behind this study is that strong moves higher tend to weaken before they roll over. The five days up suggest the move is strong. Since they rarely turn on a dime, this 1st dip is not likely the end of the up move.

Initially there appears to be a moderate inclination for a move higher. Once you get out 9-10 days the upside edge appears solid. The idea behind this study is that strong moves higher tend to weaken before they roll over. The five days up suggest the move is strong. Since they rarely turn on a dime, this 1st dip is not likely the end of the up move.

Wednesday, September 11, 2013

Another Study Suggesting Short-Term Strength Begets Intermediate-Term Strength

When the market starts to get short-term overbought we often see studies pop up that suggest a downside edge. But when the overbought condition gets very strongly overbought, then those downside edges often disappear. And rather than strength leading to weakness the strength will beget more strength. The strong move higher over the last several days has turned the market so overbought that downside edges are no longer prevalent. We saw this in a study yesterday morning and another one popped up Tuesday afternoon. The study below exemplifies the kind of extreme short-term overbought scenario the market is now in.

The numbers here are basically neutral for the first week or so. On a short-term basis there is no edge apparent. But once you get out 2-3 weeks, it appears the strength has re-asserted itself and the market is often higher.

The numbers here are basically neutral for the first week or so. On a short-term basis there is no edge apparent. But once you get out 2-3 weeks, it appears the strength has re-asserted itself and the market is often higher.

Tuesday, September 10, 2013

What the String of 5 Higher Closes Under These Circumstances is Suggesting

Today’s study utilizes a phenomenon that I have spoken of a number of times in the past. That is that when the market begins to get overbought it will often suggest a pullback is likely, but when overbought gets powered through then odds will sometimes shift from a pullback to a continuation of that move. This study demonstrates the continuation concept. It also examines a setup that suggests the market is 1) in a long-term uptrend, and 2) overbought short-term, but 3) not stretched intermediate-term.

These results appear to suggest a pretty consistent upside edge over the next 1-3 weeks. The short-term (1-4 days) is a little dicey and I am seeing other evidence saying a short-term pullback could occur. But the action of the last week seems to have generated some nice momentum for the following weeks.

These results appear to suggest a pretty consistent upside edge over the next 1-3 weeks. The short-term (1-4 days) is a little dicey and I am seeing other evidence saying a short-term pullback could occur. But the action of the last week seems to have generated some nice momentum for the following weeks.

Friday, September 6, 2013

A Big SPY Up Day Follow By A Low-Volume Tight Range Has Often Led To Trouble

Big intraday rallies like we saw on Wednesday that have been followed by tight, low volume consolidations like Thursday have often seen the market roll over. The study below looks at this setup. I last discussed it in in the 8/11/09 Subscriber Letter. The parameters have only been met 10 previous times by SPY. I have listed them all along with their 5-day returns below.

Instances are low but the inclination so far is strongly bearish. The last 7 occurences closed lower 5 days later, and all by at least 1.3%. Additionally, the Avg Drawdown is nearly 3x the Average Run-up. Even with the low number of instances, I think this study is worth some consideration.

Instances are low but the inclination so far is strongly bearish. The last 7 occurences closed lower 5 days later, and all by at least 1.3%. Additionally, the Avg Drawdown is nearly 3x the Average Run-up. Even with the low number of instances, I think this study is worth some consideration.

Thursday, September 5, 2013

7 Real Deal Traders With Quality Services

Labor Day according to Wikipedia is a holiday “dedicated to the social and economic achievements of workers”. So I was thinking this past weekend about some of the hardest working traders I know. People that not only trade for a living, but as I do, offer products designed to help traders find their way. I made a list of “Real Deal” guys. To qualify for the list you need to meet some very specific, rigid, and somewhat unfair criteria.

1) You must actually be a trader (and make money doing it).

2) You must have a product that I am familiar with and I truly think is valuable to others.

3) I am able to verify 1 & 2 through personally knowing the person. This means we have either met in person, or at a bare minimum, have had several long phone conversations over an extended period of time. If I don’t know you, you aren’t on this list (that’s the unfair part).

4) You are not part of a large organization. I started writing this with Labor Day in mind. I know how hard it is to run a small operation and have to wear so many hats. Everyone on the list is similar in that they are either solo or have at most a handful of people working with them.

So these are all people I feel I know to some degree and who I believe have something valuable to offer. I also think they are upstanding folks who I am comfortable recommending. Of course I think Quantifiable Edges & Overnight Edges are the greatest services out there, but they don’t match everyone’s style, and they don't cover everything. So here are some other Real Deals to check out (in alphabetical order).

Scott Andrews (www.masterthegap.com) – “The Gap Guy”. Scott’s quantitative testing is similar to mine, but is focused on gap fading, and some intraday breakout analysis. I think he provides solid information for daytraders, I like his style, and he has become a friend over the years.

Charles Kirk(http://www.kirkreport.com/) – At $100/year a Kirk Report subscription should be a no-brainer for nearly every trader. His screens, analysis, links, and experience make this a resource well worth checking out. The Kirk Report turned 10-years old this week, showing that this “real deal” (and all-around good guy) has had some staying power.

Dave Landry (http://www.davelandry.com/)– Dave’s been around a long time. I’ve always liked his work and his ability to keep things simple. Dave’s sense of humor always seems to shine through as well. He’s tough not to like.

Bill Luby (http://vixandmore.blogspot.com/) – VIX & More is a terrific blog. And traders with an eye on volatility should check out Bill’s subscription products as well. He is an incredible resource and a real authority on volatility and ways to take advantage of it. When it comes to the VIX, Bill is THE real deal.

Tom McClellan (http://www.mcoscillator.com/) – Tom is one of the most interesting analysts I know. His liquidity wave approach and price pattern analogs never cease to grab my attention. I’ve also incorporated some of his work & ideas into Quantifiable Edges (such as the TICK TomOscillator). His knowledge also goes far beyond stocks. I’ve met Tom a number of times, and have learned something new about science or history every time.

Jeff Pietsch (http://etfprophet.com/etf-rewind-pro/)– Jeff does not blog as much anymore, but his ETF Rewind product is a great tool for ETF traders. It puts the ETF universe in a neat, sortable, format and makes it easier for traders to find opportunities based on a number of technical criteria.

Corey Rosenbloom (http://www.afraidtotrade.com/) – The last hard worker on this alphabetical list is also the youngest of the group. But he does not lack for wisdom (or enthusiasm for his own work). Corey takes a solid approach to daytrading and is certainly worth checking out.

That’s it. Seven Real Deal people whose work I admire. Check ‘em out when you get a chance.

Oh yeah. Might as well plug myself as well. Check out a subscription to Quantifiable Edges (free) or Overnight Edges ($5) sometime if you haven’t before.

1) You must actually be a trader (and make money doing it).

2) You must have a product that I am familiar with and I truly think is valuable to others.

3) I am able to verify 1 & 2 through personally knowing the person. This means we have either met in person, or at a bare minimum, have had several long phone conversations over an extended period of time. If I don’t know you, you aren’t on this list (that’s the unfair part).

4) You are not part of a large organization. I started writing this with Labor Day in mind. I know how hard it is to run a small operation and have to wear so many hats. Everyone on the list is similar in that they are either solo or have at most a handful of people working with them.

So these are all people I feel I know to some degree and who I believe have something valuable to offer. I also think they are upstanding folks who I am comfortable recommending. Of course I think Quantifiable Edges & Overnight Edges are the greatest services out there, but they don’t match everyone’s style, and they don't cover everything. So here are some other Real Deals to check out (in alphabetical order).

Scott Andrews (www.masterthegap.com) – “The Gap Guy”. Scott’s quantitative testing is similar to mine, but is focused on gap fading, and some intraday breakout analysis. I think he provides solid information for daytraders, I like his style, and he has become a friend over the years.

Charles Kirk(http://www.kirkreport.com/) – At $100/year a Kirk Report subscription should be a no-brainer for nearly every trader. His screens, analysis, links, and experience make this a resource well worth checking out. The Kirk Report turned 10-years old this week, showing that this “real deal” (and all-around good guy) has had some staying power.

Dave Landry (http://www.davelandry.com/)– Dave’s been around a long time. I’ve always liked his work and his ability to keep things simple. Dave’s sense of humor always seems to shine through as well. He’s tough not to like.

Bill Luby (http://vixandmore.blogspot.com/) – VIX & More is a terrific blog. And traders with an eye on volatility should check out Bill’s subscription products as well. He is an incredible resource and a real authority on volatility and ways to take advantage of it. When it comes to the VIX, Bill is THE real deal.

Tom McClellan (http://www.mcoscillator.com/) – Tom is one of the most interesting analysts I know. His liquidity wave approach and price pattern analogs never cease to grab my attention. I’ve also incorporated some of his work & ideas into Quantifiable Edges (such as the TICK TomOscillator). His knowledge also goes far beyond stocks. I’ve met Tom a number of times, and have learned something new about science or history every time.

Jeff Pietsch (http://etfprophet.com/etf-rewind-pro/)– Jeff does not blog as much anymore, but his ETF Rewind product is a great tool for ETF traders. It puts the ETF universe in a neat, sortable, format and makes it easier for traders to find opportunities based on a number of technical criteria.

Corey Rosenbloom (http://www.afraidtotrade.com/) – The last hard worker on this alphabetical list is also the youngest of the group. But he does not lack for wisdom (or enthusiasm for his own work). Corey takes a solid approach to daytrading and is certainly worth checking out.

That’s it. Seven Real Deal people whose work I admire. Check ‘em out when you get a chance.

Oh yeah. Might as well plug myself as well. Check out a subscription to Quantifiable Edges (free) or Overnight Edges ($5) sometime if you haven’t before.

Friday, August 30, 2013

An Updated Look At The Friday Before Labor Day

The Friday before Labor Day has long been a strong seasonal day for the market. The study below is one I also showed last year. The stats table based on buying the Thursday before Labor Day and selling the close on Friday.

With 71% of the days finishing higher, a profit factor of over 2.5, and an average trade of 0.3% the stats are quite compelling. Regardless how it plays out today, I hope everyone has a great Labor Day weekend!

With 71% of the days finishing higher, a profit factor of over 2.5, and an average trade of 0.3% the stats are quite compelling. Regardless how it plays out today, I hope everyone has a great Labor Day weekend!

Thursday, August 29, 2013

A Simple Look At Bounces From 20-Day Lows During Long-Term Uptrends

The study below is from last night’s Subscriber Letter. It looks at a possible reversal pattern off a 20-day low, and uses very simple criteria.

Results here seem to suggest a solid upside edge. Intermediate-term lows in long-term uptrends often offer buying opportunities. And they are commonly good for more than just a 1-day bounce.

Tuesday, August 27, 2013

A Look At Recent 1% Gap Down Days

SPY is looking like it could open down over 1% this morning. While a 1% gap may have been considered small in the fall of 2008, this would be only the 3rd time this year that SPY gapped down as much as 1%. Below I have listed all 1% gap downs since the beginning of 2012, and how they fared from open to close.

More often than not they have gained back some losses during the day, but it certainly has not been a lock. Good luck trading today.

More often than not they have gained back some losses during the day, but it certainly has not been a lock. Good luck trading today.

Tuesday, August 20, 2013

3 Lower Highs, Lows, & Closes Going Into Tuesday

At

Overnight Edges yesterday I noted that there was a strong bullish overnight

edge when ES had made at least three consecutive lower highs, lows, and closes.

I’ve also discussed in the past that Tuesdays

are known for their turnaround capabilities. The study below uses SPY and

it looks at swing-term implications of the 3+ days of lower highs, lower lows,

and lower closes when today is Monday.

As you can see the numbers are very strong. Not seen in the above table is the fact that

33 of the 34 instances closed above the entry price at some point in the next 4

days. This all points to a strong

likelihood of a bounce.

Friday, August 16, 2013

What Thursday's Unfilled Gap Down & Poor Close Suggest For The Next 2 Weeks

The study below is one that I have shown before, but not for a while. It looks at days like Thursday where SPY posts an unfilled gap down that closes poorly while the market is in a short-term downtrend, but a long-term uptrend. Results are updated.

Results are strong right from the start and look good throughout the first two weeks. This one favors the bulls.

Results are strong right from the start and look good throughout the first two weeks. This one favors the bulls.

Tuesday, August 13, 2013

No Turnaround Edge This Tuesday?

Tuesday has shown strong inclinations to turn around over the years when there has been a pullback leading up to it. But when the pullback has been 2 days old and the market has been in a long-term uptrend, that turnaround inclination has not held true.

Whose fault is that? Not the overnight.

It's been the day session. Below is a are the results of going long Tuesday morning after a 2-day pullback during an uptrend, and then exiting at the close.

As you can see, the stats show a moderate downside inclination. I also produced a profit curve to see how this has played out over time.

A bit choppy, but it has been headed lower for a long time. Traders may want to be a little cautious about jumping aboard the "Turnaround Tuesday" train today. The market has historically struggled between open and close under similar scenarios.

Thursday, August 8, 2013

Recording of Quantifiable Edges MTA Webinar

I am out of the office again today. The blog will return to normal next week. But if you cannot wait that long for some Quantifiable Edges research, below is a link to an MTA webinar I recently did. This one discussed trading edges related to long-term, short-term, and overnight trading.

The MTA, which stands for Market Technicians Association, is a top-notch organization. I would recommend all traders interested in technical analysis check it out and see what they have to offer.

Here is a link to the July 17 2013 webinar:

"Quantifiable Edges for Trading"

And here is a link to the MTA website in case you would like to learn more about it:

http://www.mta.org/eweb/StartPage.aspx

The MTA, which stands for Market Technicians Association, is a top-notch organization. I would recommend all traders interested in technical analysis check it out and see what they have to offer.

Here is a link to the July 17 2013 webinar:

"Quantifiable Edges for Trading"

And here is a link to the MTA website in case you would like to learn more about it:

http://www.mta.org/eweb/StartPage.aspx

Wednesday, August 7, 2013

Overnight Trading Presentation

I have been taking some time away in the last couple of weeks. And while the subscriber service has carried on as normal, the blog has suffered. I'll be back in a few days to again ramp up the blog. But for those of you who are yearning for some Quantifiable Edges, feel free to check out the presentation I did with Tradestation near the end of June.

"Overnight Edges - Using Historical Tendencies to

Anticipate Overnight Market Movement" - A webinar given

June 18, 2013 as part of Tradestation's "Spotlight On..."

series.

Tuesday, July 23, 2013

The 3-Day Pattern That Suggests A Bearish Edge For Today

The last 3 days have created an interesting setup. Thursday SPY made a new 50-day closing high. Friday SPY posted an inside day. And then Monday was another 50-day closing high. This has only happened 16 other times since 1999. Below is a list of all the instances along with their performance the next day.

Risk/reward here heavily favors the short side. The average drawdown is nearly 4 times the size the average run-up. Also notable is that every instance saw drawdown of at least 0.35% the next day, but only 1 of the 16 instances saw run-up of at least 0.35%. Futures are up 2.5 points right now about an hour before the open, but there may be some headwinds based on this pattern.

Risk/reward here heavily favors the short side. The average drawdown is nearly 4 times the size the average run-up. Also notable is that every instance saw drawdown of at least 0.35% the next day, but only 1 of the 16 instances saw run-up of at least 0.35%. Futures are up 2.5 points right now about an hour before the open, but there may be some headwinds based on this pattern.

Friday, July 19, 2013

This Setup Suggests More Upside In The Next Few Days

Thursday marked the 2nd day in a row that SPY posted an unfilled gap up. It also closed at a 50-day high. The unfilled up-gaps are considered a sign of strength. Unfilled up gaps can sometimes be seen as a sign of strength. The study below examines whether this may be the case when the market is at an intermediate-term high.

The size of the follow-through isn't terribly large, but it has been very, very consistent that some follow through was achieved. This suggests a good chance at more upside in the next few days.

I will note that not every study I am seeing is bullish right now. There is a bit of a mix.

The size of the follow-through isn't terribly large, but it has been very, very consistent that some follow through was achieved. This suggests a good chance at more upside in the next few days.

I will note that not every study I am seeing is bullish right now. There is a bit of a mix.

Thursday, July 11, 2013

Sometimes Overbought Suggests More Strength

When the market begins to get overbought it will often suggest a pullback is likely. When overbought gets powered through then odds will sometimes shift from a pullback to a continuation of that move. The last two nights I have seen some studies suggesting this scenario. The study below is on that I have showed a few times in the past. All stats are updated.

These results appear to suggest a pretty consistent upside edge over the next 1-3 weeks. In fact, below is a profit curve showing just how consistent it has been over the years using a 10-day exit.

That's an impressive upslope for a period covering over 50 years.

Tuesday, July 9, 2013

When VXO is Stretched to the Downside

One index providing interesting readings is VXO (the old VIX calculation). On Monday it closed a little more than 15% below its 10ma. And it may do that again today. At one time, such rapid drops in the VXO were often followed by a move lower in the SPX. But this has not been as consistent in recent years. Below is a study I showed in last night’s Subscriber Letter.

Stats here seem to suggest a bit of a downside inclination. But the equity curve tells a little bit of a different story.

The downside edge seemed apparent for the 1st 60 instances or so. But the last 25, all of which occurred over the last 3 years since June 2010, have been extremely choppy and shown no progress. For whatever reason the market seems to have changed, and traders should be aware of that.

Stats here seem to suggest a bit of a downside inclination. But the equity curve tells a little bit of a different story.

The downside edge seemed apparent for the 1st 60 instances or so. But the last 25, all of which occurred over the last 3 years since June 2010, have been extremely choppy and shown no progress. For whatever reason the market seems to have changed, and traders should be aware of that.

Monday, July 8, 2013

QE Big Time Swing System Posts A Strong 1st Half for 2013

I’ve updated the Quantifiable Edges Big Time Swing System overview page with results through June 30. There have been no trades since then. The system only averages about 1 trade per month, so I typically update the results bi-annually. The QE Big Time Swing System has been on a roll in 2013. It has had 6 trades, one of which was a carry-over from near the end of 2012. Five of these trades have been to the long side, and one short. All of them posted gains. The signals produced a net return of 10.84% for SPY (including dividends, commissions of $0.01/share, and an assumed interest rate on cash of 0.1%). The system also continues to make new equity highs.

The Big Time Swing System provides easy to follow mechanical rules. The standard parameters are not optimized and have performed quite well (they are the ones used for all performance metrics). There are only about 11 trades per year averaging 7 trading days per trade. All entries and exits are either at the open or the close. And to be sure you have everything set up properly traders may follow the private purchasers-only blog that tracks all SPY signals and possible entry/exit levels. This service is free for 12 months from the date of purchase.

For system developers looking for a system that they can use as a base to build their own system from, the Big Time Swing is an attractive option. It is all open-coded and comes complete with a substantial amount of background historical research. And since it is only in the market about ¼ of the time, it can easily be combined with other systems to provide greater efficiency of capital. Once you’re ready to try and improve the system yourself you can also refer to the system manual or the August 2010 purchaser-only webinar – both of which discuss numerous ideas for customization.

For more information and to see the updated overview sheet, click here.

If you’d like additional information about the system, or have questions, you may email BigTimeSwing @ Quantifiable Edges.com (no spaces).

The Big Time Swing System provides easy to follow mechanical rules. The standard parameters are not optimized and have performed quite well (they are the ones used for all performance metrics). There are only about 11 trades per year averaging 7 trading days per trade. All entries and exits are either at the open or the close. And to be sure you have everything set up properly traders may follow the private purchasers-only blog that tracks all SPY signals and possible entry/exit levels. This service is free for 12 months from the date of purchase.

For system developers looking for a system that they can use as a base to build their own system from, the Big Time Swing is an attractive option. It is all open-coded and comes complete with a substantial amount of background historical research. And since it is only in the market about ¼ of the time, it can easily be combined with other systems to provide greater efficiency of capital. Once you’re ready to try and improve the system yourself you can also refer to the system manual or the August 2010 purchaser-only webinar – both of which discuss numerous ideas for customization.

For more information and to see the updated overview sheet, click here.

If you’d like additional information about the system, or have questions, you may email BigTimeSwing @ Quantifiable Edges.com (no spaces).

Monday, July 1, 2013

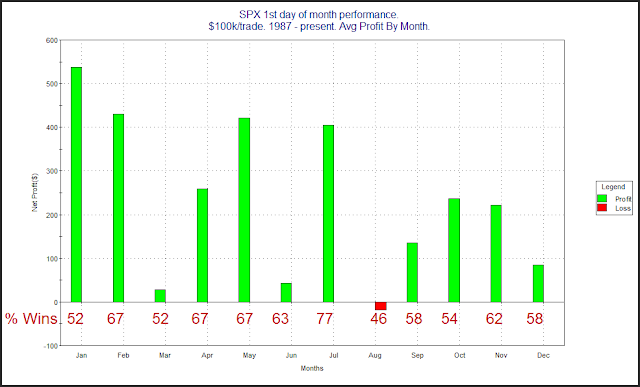

1st Day of Month Tendency Broken Down By Month

Since the late 80s there has been a strong tendency for the market to rally on the first day of the month. One theory on why this occurs is that there are often 401k inflows that are put to work on the 1st of the month. A few years ago I examined this tendency and broke it down by month. I thought it would be interesting to take another look at it today. Below is an updated version of the study shown here on July 1, 2009.

July has been the most reliable month in term of closing positive, but when looking at the size of the average gain, it comes in 4th. You also note that August is the worst on both counts.

July has been the most reliable month in term of closing positive, but when looking at the size of the average gain, it comes in 4th. You also note that August is the worst on both counts.

Subscribe to:

Posts (Atom)