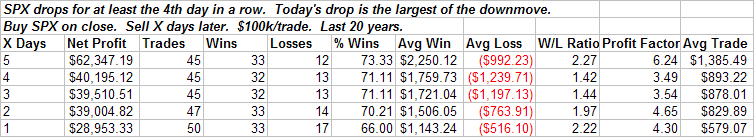

After trading lower for three days in a row, the S&P 500 (and most everything else) completely collapsed today, finishing down about 3%. Below is a study that shows the short-term statistics following similar setups:

The edge erodes after the 1st week. It’s basically a short-term setup. To give some perspective on how often any kind of bounce above the entry occurred I ran a 2nd study that looked to exit any time the trade closed profitable.

Pretty impressive reliability. Here we see 81% winners within the next 2 days, 89% within a week and 96% within 8 trading days.

Today’s drop was not only the biggest of the move down, it was over twice the size of the next biggest drop (last Friday). Generally, the more extreme the drop in comparison to the other days, the better the results. Below are the stats associated with a 2x drop similar to today:

Better winning percentage, higher average wins and lower average losses make for better overall stats. I also ran the “1st profitable exit” strategy here:

Thirteen of fourteen were positive within 3 days. By day 8, all fourteen instances were positive.

This all suggests a reflex move higher is likely in the next few days.

13 comments:

Well done Rob - you've got my wheels turning with this one.

ms

I'm having trouble following the results for selling after the first profitable day. For example, the first day had 50 trades with 33 of them profitable (so on 33 out of 50 trades we would have exited after the first day). It would seem to me that would leave 17 possible trades on day 2; however, your day 2 shows 47 possible trades.

What am I missing?

dan

I don't feel comfortable at all to use studies in todays environment without using a bear market filter. ie 200 MA sloping down or such.

Would very much appreciate if you did the same study and the ones to follow to take that into consideration.

I hope most agree!

JL

I have heard that if there is a big decline on Thursday and the market is unable to close flat to up on Friday, Monday can have a high probability of being ugly. Do you have any work that indicates that is true?

Rob, thank you for the study! Two questions for you:

1) is there a comparable edge for individual securities or commodities?

2) Thinking of where to place stops: how does the distribution of max adverse movements after the purchase look like?

Thanks, Anton

Rob,

Nice analysis. Why no analysis is perfect, yours does show a pretty good edge to a quantifiable situation.

The one other things I've noticed is the talk on the message boards of the dozen or so blogs I like to read. The fear is palpable...everyone is talking about downside stops, protection and what to do. I'm not sure how you quantify this but it is interesting.

Cheers,

Marc

Rob:

Per your earlier post, I am wondering if you have done a similar study in reverse. That is, is there significance to a day when the market is up but breadth is poor?

Eric

Ok - I'll attempt to get through a few of the questions -

Dan - number is reduced from 50 to 47 because a trade would have triggered 2 days in a row. It's a repeat instance and the 2nd trade is not taken since the system is already long.

Johan - I didn't filter further because the number of instances was already fairly low.

Sam - I don't recall testing that particular setup.

Anton - I look for this kind of action in individual stocks as well as ETFs.

2) Using test #4, max drawdown was about 2.5%.

Eric - See June 10 blog.

Mike and Marc - Thanks for the input.

Rob, I'm specifically speaking to the analysis where you sell at the close on the first profitable day. If you had 50 trades on day one and 33 of them were profitable at the end of day 1, then it seems that your universe would have shrunk on day 2 to only 17 (or fewer if repeats are present). I'm confused because I don't see your table reflecting this.

Dan - The winners are closed but still included in the totals in that table. I included them so you could easily see the % Winners and stats on all trades, not just the few that were remaining (which are found in the losing columns.)

One thing I noticed while duplicating this study in Worden's Backscanner (daily bars only back to late '00) is that this event occurred fairly often near the beginning of the last bear. In a span of 5 months from late '00 to early '01 it happened 4 times and twice more before the eventual bottom. In the ensuing 5 year bull, I only count 2, one of which could be considered part of the bottoming process in '03 and the other immediately following the Feb. 27th '07 selloff. Perhaps a longer-term message can be interpreted by tracking the frequency of this particular market event?

Rob,

I've been going over your most profitable strategies. I have a question about your method.

On your site, or others, I've seen equity curves purporting to show a significant change in market behavior since the 2002 era sell off.

It would be extremely useful to see the equity curves of your system results. A high return system tested over a 25 year period could have huge returns prior to 2002, and have abysmal returns since then. The equity curve would highlight this.

speaking of accelerated downside selloffs, the NDX's been down 6 straight days now (being today, Monday, Sept. 8th.) also looking at the 1 year chart, the selloff pattern look similar to early Nov/07 and Jan/08. what i get from these is that a short term bounce is due but the long and intermediate term seems bearish to me.

Jimmy

Post a Comment