Stock traders are aware that it is generally beneficial to have the market on your side. Whether the market moves up or down will often have an influence on an individual stock or ETFs movement. As they say, a rising tide will lift all boats. Yet too often traders (especially short-term traders) either ignore the general market action or underemphasize it in their decision making. They’ll look for a trigger without carefully considering the likely direction of the market.

I have found trading with the general market on my side to be of great importance. In August I conducted a study for my gold subscribers that demonstrated and quantified this concept.

As part of their gold subscription, traders have access to 11 different swing trading systems. On the system pages they are able to see the rules, Tradestation code, and backtest results across 2 lists of securities. One list is the S&P 100 and the other is a list of about 100 ETFs. The ETF list looks just at equity ETFs. It does not include any inverse or leveraged ETFs and there are no duplicates in coverage (like SPY & IVV). Most of the systems were first published within a few months of the subscriber letter first being published over 2 ½ years ago. When updating all the original backtests in late August I decided to see how the system performed when there was a perceived market edge versus times there wasn’t.

Many readers are aware of my Aggregator tool. The Aggregator utilizes the market studies I publish in the subscriber letter (and sometimes in the blog). It uses them to generate short-term market projections. Aggregator configurations can produce a long, short, or flat bias. A more detailed description of the Aggregator can be found here. A post describing how the Aggregator has been used as a system can be found here. The bottom line is that the Aggregator is my #1 tool for setting my short-term market bias. It also has a history dating back to the inception of the subscriber letter so I can easily see what my bias was going in to any given day.

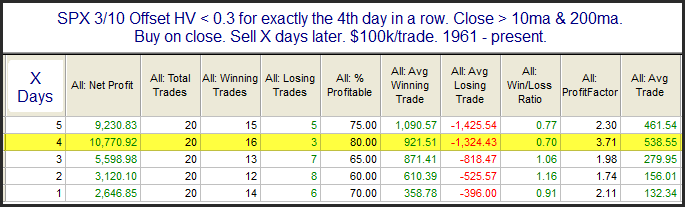

So to quantify the value of trading with the market on my side, I ran tests on all 11 numbered systems to show their performance over the last 2 ½ years. I filtered the results to show trades that were accompanied by a confirming Aggregator signal versus trades with a neutral or offsetting Aggregator signal. In general I found results to strongly favor entering trades at times when there was also a perceived market edge (confirming Aggregator signal). Below is a partial example of the results that are shown on the website. This is “System 80509”. It looks to enter long trades in strongly oversold securities.

The discrepancy here is more substantial than was seen in many of the results. Still, the general results suggested you are much better off trading with the market winds at your back.

The lesson here is not that you need to utilize Quantifiable Edges systems or the Aggregator tool to enhance your results. It does mean that whatever trading methodologies you are using, you will likely stand a much better chance of success if you also incorporate some solid market analysis as a filter.

One last note for advanced system developers and testers. Complete historical Aggregator values are available with a QE subscription. You could easily download and apply them as a filter to test the effect on any of your own systems.