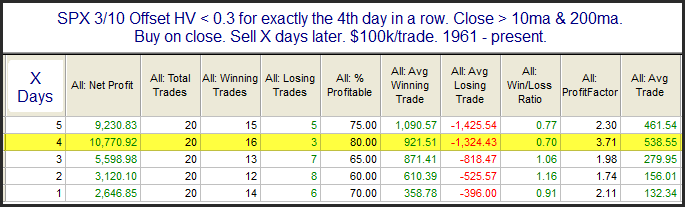

These results would seem to suggest an upside edge. But I also looked deeper. Below is a listing of all 20 instances going back to 1960.

What I find most notable are the dates of the occurrences. As you can see most of the instances took place in the 60s and 70s. Also, this is the 1st instance in over 14 years. Personally, I’m not terribly comfortable using a study whose results are primarily achieved during the 60s and 70s and with no instances since ’96. Therefore I decided not to include it when formulating my outlook.

Many more studies lead to dead ends than lead to quantifiable edges. When deciding what to include in your analysis, it is important to be intellectually honest with yourself. Traders should look to trade aggressively when edges strongly suggest a bias. It is just as important to remain patient and conserve capital when evidence is mixed or lacking.

1 comment:

I like the honesty you're approaching the analysis with. Is there any way to analyze bid spreads and ask spreads instead of just traded prices? I feel like you would notice a "coiled market" soooo much easier that way.

(If you have intraday you could estimate where the stops were the day before. Thinking of Agustin Silvani's book.)

Post a Comment