In the past this setup has commonly been followed by a short-term pullback. The downside edge doesn't last long, though. It seems to pretty much play itself out over the first 2 days. It is not an overwhelming edge, but it is still worth noting that SPY has been short-term extended for a while and the normal course of action at this point is a little pullback.

Thursday, January 2, 2014

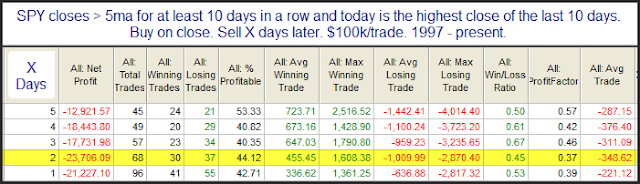

Some Evidence It Is About Time For SPY To Pull Back

SPY has now gone 11 days without closing below its 5ma, and it closed Tuesday at another new high. The study below is one I’ve shown a few times over the years, most recently in October. It looks at other instances in which SPY has traded above the 5ma for at least 2 weeks and is now closing at a 10-day high. All results are updated.

In the past this setup has commonly been followed by a short-term pullback. The downside edge doesn't last long, though. It seems to pretty much play itself out over the first 2 days. It is not an overwhelming edge, but it is still worth noting that SPY has been short-term extended for a while and the normal course of action at this point is a little pullback.

In the past this setup has commonly been followed by a short-term pullback. The downside edge doesn't last long, though. It seems to pretty much play itself out over the first 2 days. It is not an overwhelming edge, but it is still worth noting that SPY has been short-term extended for a while and the normal course of action at this point is a little pullback.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment