As you can see the market has strongly favored a quick move higher. And when that move hasn’t happened on Tuesday it has often happened in the next few days.

Tuesday, January 31, 2012

The Odds That Turnaround Tuesday Lives Up To Its' Name...

I’ve shown before that of all days Tuesday has historically shown the highest propensity to halt a short-term pullback. The study below is one from the larger Turnaround Tuesday study. All stats are updated..

As you can see the market has strongly favored a quick move higher. And when that move hasn’t happened on Tuesday it has often happened in the next few days.

As you can see the market has strongly favored a quick move higher. And when that move hasn’t happened on Tuesday it has often happened in the next few days.

Wednesday, January 25, 2012

When SPX Closes Just Under a 50-day High Prior to a Fed Day

Yesterday I showed that Fed Days typically carry a bullish edge, but that edge failed to hold when the SPX closed at a 20-day high just prior to the Fed Day. By closing down 0.1% Tuesday the SPX narrowly missed closing at a 20-day high. So are we now safe because the market just missed a new high by 0.1% on Tuesday? Last night I suspected not. And so I ran the below test. Since we are near a 50-day high I used that as the filter rather than a 20-day high. I looked at times where the SPX did NOT close at a 50-day high, but in fact closed less than 0.5% below it. So although it is not a new high, the environment still appears positive. Let’s look at the results.

Twenty-five instances and the result is nearly dead-even. This is very similar to what we saw with yesterday’s study. I’m not viewing today as a typical strongly-bullish Fed Day.

Twenty-five instances and the result is nearly dead-even. This is very similar to what we saw with yesterday’s study. I’m not viewing today as a typical strongly-bullish Fed Day.

Tuesday, January 24, 2012

Intermediate-Term Highs Prior to Fed Days

Wednesday is a Fed Day. As I have discussed many times, Fed Days generally carry an upside tendency. But this tendency is greatly impacted by certain variables. A large collection of these variables may be found here on the blog under the “Fed Day”label. And many more may be found in the “Quantifiable Edges Guide to Fed Days”.

One variable I briefly discussed in the 11/3/10 blog was whether the market was already at an intermediate-term high. Today I thought I would illustrate that study graphically.

First, let’s take an updated look at SPX performance on Fed Days when the SPX has NOT closed at a 20-day high the day before.

That’s basically 30 years of bullishness.

But now let’s see performance at times when the SPX did close at a 20-day high the day before.

No consistency and no pronounced edge in this sample of 36 instances.

Traders looking to play for a short-term Fed Day bump should be hoping the SPX does not close up and at a new high again today.

Friday, January 20, 2012

When the Market Closes Strong Just Prior to Op-Ex Day

Despite the negative seasonality that is typical during January op-ex and MLK week (which are often the same) the market has continued to rise and closed Thursday at a new rally high. The study below was last seen in the 2/18/11 subscriber letter. It examines performance when the SPX closes in the top 10% of its 10-day range on the Thursday before op-ex. Stats have been updated.

The numbers here are fairly compelling and suggest a possible downside edge. Prior to 2003 the edge was less pronounced but still negative.

The numbers here are fairly compelling and suggest a possible downside edge. Prior to 2003 the edge was less pronounced but still negative.

Tuesday, January 17, 2012

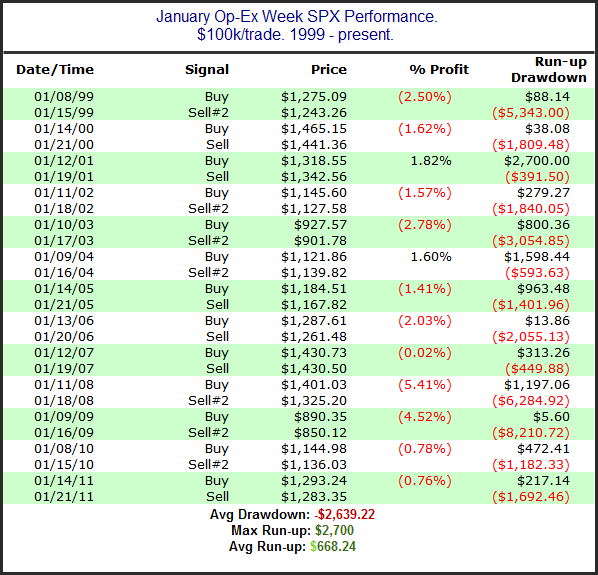

January Op-ex Week's Recent Struggles

January op-ex week has been a tough week for the market since 1999. Interesting about January op-ex week is that it often occurs in conjunction with Martin Luther King Day. Below is a list of the last 13 January op-ex weeks with their performance results. Note that some of these weeks contained four trading days and some contained five. In either case the market was assumed to have been “bought” the Friday before op-ex Friday and “sold” on op-ex Friday.

As you can see there has been a decided downside tendency over the last 13 years. The drawdown / run-up stats at the bottom are especially compelling for the bears.

As you can see there has been a decided downside tendency over the last 13 years. The drawdown / run-up stats at the bottom are especially compelling for the bears.

Wednesday, January 11, 2012

New High, Unfilled Up Gaps, but Weak Finishes

While the final numbers were good and the SPY left an unfilled upside gap, some traders may have been disappointed yesterday that the SPY finished in the lower part of its daily range. Historically, unfilled gaps and 20-day intraday highs as was put in on Tuesday have been followed by much more positive action when the rally closed meekly. Tuesday's action actually appears bullish. This is something I examined just last week in the 1/4/12 Subscriber Letter. Below is an excerpt from that letter.

I ran a test of performance following unfilled upside gaps that make a 20-day high. Below I’ve broken out the results by times the SPY closed above the open versus times where it closed below the open.

First let’s look at those times where the finish was relatively strong:

There doesn’t appear to be any edge in either direction here. Now let’s examine times like the present where SPY closed below the open.

These results are substantially better than earlier where the finish was good. Rather than worrying about the weak finish bulls should be excited by it.

I ran a test of performance following unfilled upside gaps that make a 20-day high. Below I’ve broken out the results by times the SPY closed above the open versus times where it closed below the open.

First let’s look at those times where the finish was relatively strong:

There doesn’t appear to be any edge in either direction here. Now let’s examine times like the present where SPY closed below the open.

These results are substantially better than earlier where the finish was good. Rather than worrying about the weak finish bulls should be excited by it.

Monday, January 9, 2012

When SPX is Above the 200ma and Closes Down on an Employment Day

One study that triggered on Friday examined performance the day after an Employment Day (typically the 1st Friday of each month) when the SPX was above its 200-day moving average and the Employment Day closed down.

The stats here are strong and all point to a decent upside edge.

The stats here are strong and all point to a decent upside edge.

Friday, January 6, 2012

2011 (and prior) Trade Idea Results from the QE Subscriber Letter

I don't often discuss trade idea results from the subscriber letter here on the blog. The last time I did was in June. But 2011 was another solid year and I thought it would be worth mentioning in the hope that Quantifiable Edges could help traders improve their results in 2012. I don’t post results regularly because while I've always tracked trade ideas in the subscriber letter, it isn't the main focus of the service. I don't consider Quantifiable Edges to be a stock picking service. I consider it one where traders can gain market and trading knowledge through the published research, systems, and tools. The objective is to provide tools and instruction to help traders improve their own trading and results.

But the published trade ideas have done quite well. In fact, during 2011 October was the only month where the trade ideas failed to add up to positive gains. I've had several letters from subscribers lately telling me they've done quite well following certain ideas and that is always nice to hear.

I don't suggest position sizes, and I would never suggest that the trade ideas represent any kind of complete portfolio strategy. They are what they are - ideas about certain stocks or ETFs that have historically provided a statistical edge.

It is important to note that all of the trade ideas are in either ETFs or in highly liquid large cap stocks (almost exclusively S&P 100 components). I do this so that executing trades and getting fills at reasonable prices is not an issue. I think traders feel the most frustrating aspect of following trade ideas offered by some services is not being able to get into or out of the trades that they suggest at a similar price. I’ve addressed this problem with limit prices and highly liquid securities.

Some of my goals with a gold subscription have always been to help people improve their trading through the use of quantified research, and while doing so to help them offset the costs of the subscription by offering easy-to-execute trade ideas with a long-term positive profit expectancy. To date I believe Quantifiable Edges has succeeded in doing this.

Today I broke the results down by year. Amazingly, for the 2nd year in a row the trade ideas during 2011 averaged a 1.00% gain per trade idea. I also listed all of December and January’s (so far) results below so that traders could see some examples. For tracking purposes I only count trades after they have been closed out. With most trades being of the swing variety this doesn’t normally skew results much. But we did just close out a big winner that was entered in November so 2012 results are overstated while 2011 are a bit understated due to that particular trade. First let’s look at the results by year:

Now recent trade ideas:

For those that are interested, the complete list of trade ideas from 2008 - present can be downloaded from the systems page of the members’ section of Quantifiable Edges. (Available to paid and trial subscribers.) And with the full archive of subscriber letters available on the site, gold subscribers can also go back and see what I wrote about any trade and my reasons for entry and exit when it happened.

With a subscription to Quantifiable Edges I try and provide traders with ideas and instruction to improve their trading. These ideas may come in the form of previously published studies identified by the Quantifinder, or they may be something I discuss in the current subscriber letter, or perhaps it's a webinar focused on a certain trading approach or indicator, or any other number of tools that I've designed and made available. (For a more complete list of tools, see the "Using Quantifiable Edges" series of posts.) The trade ideas found in the subscriber letter are examples of how I put these tools and ideas to work. While past performance is not necessarily indicative of future results, over the long run they’ve performed well enough that many subscribers have used them for their benefit.

For more information on a gold subscription, or to subscribe, click here.

Lastly, below is the explanations and disclaimer from the Trade Ideas Results Spreadsheet.

All trade ideas ever tracked in the Quantifiable Edges Subscriber Letter may be found on this spreadsheet. I don’t suggest position sizes. The primary reason for this is I’m not acting as a financial advisor. I don’t feel it is appropriate to suggest allocation sizes without understanding someone’s financial situation and risk tolerance. Even for my own trading I run different portfolios with different levels of aggressiveness. For instance, my most aggressive may use options to sometimes get 300-400% leveraged. Other portfolios on the other hand normally take much more conservative stances and some rarely reach or exceed 100% exposure.

Since I don’t suggest position sizes this is should not be considered a performance report, but rather a trade idea scorecard. Therefore, no matter how objective I try to be the reporting of the results is always going to be skewed depending on how you approach the trades. For instance, I always recommend scaling into the Catapult positions in 3 parts, whereas the “System” trades (whatever system I unveil other than Catapult) are normally one entry. The “Index” trades I normally recommend scaling into as well. For my own trading I trade much larger size with the index trades than any of the individuals. I also control my exposure by limiting the total amount invested per day. As I mentioned, this will vary depending on the account I’m trading. My most aggressive account I may put in up to 100%/day and get heavily leveraged using options. A more conservative account may max out at 15%-20% per day.

It’s unlikely anyone would have taken all of the trades with equal amounts, so personal results would vary greatly depending on the trader’s approach. Simply adding up the results of the individual triggers as I do is an admittedly poor representation of returns. A net positive or negative does not necessarily mean a person following the ideas would have made or lost money during the period measured. And the sum total is certainly not representative of what a portfolio would return.

Feel free to contact me at support @ QuantifiableEdges.com if you have any questions.

As required by the NFA: Except where otherwise specifically stated, all trades are based on hypothetical or simulated trading. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under-or-over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Commissions, fees, and slippage have not been included. This is neither a solicitation to buy/sell securities or listed options.

But the published trade ideas have done quite well. In fact, during 2011 October was the only month where the trade ideas failed to add up to positive gains. I've had several letters from subscribers lately telling me they've done quite well following certain ideas and that is always nice to hear.

I don't suggest position sizes, and I would never suggest that the trade ideas represent any kind of complete portfolio strategy. They are what they are - ideas about certain stocks or ETFs that have historically provided a statistical edge.

It is important to note that all of the trade ideas are in either ETFs or in highly liquid large cap stocks (almost exclusively S&P 100 components). I do this so that executing trades and getting fills at reasonable prices is not an issue. I think traders feel the most frustrating aspect of following trade ideas offered by some services is not being able to get into or out of the trades that they suggest at a similar price. I’ve addressed this problem with limit prices and highly liquid securities.

Some of my goals with a gold subscription have always been to help people improve their trading through the use of quantified research, and while doing so to help them offset the costs of the subscription by offering easy-to-execute trade ideas with a long-term positive profit expectancy. To date I believe Quantifiable Edges has succeeded in doing this.

Today I broke the results down by year. Amazingly, for the 2nd year in a row the trade ideas during 2011 averaged a 1.00% gain per trade idea. I also listed all of December and January’s (so far) results below so that traders could see some examples. For tracking purposes I only count trades after they have been closed out. With most trades being of the swing variety this doesn’t normally skew results much. But we did just close out a big winner that was entered in November so 2012 results are overstated while 2011 are a bit understated due to that particular trade. First let’s look at the results by year:

Now recent trade ideas:

For those that are interested, the complete list of trade ideas from 2008 - present can be downloaded from the systems page of the members’ section of Quantifiable Edges. (Available to paid and trial subscribers.) And with the full archive of subscriber letters available on the site, gold subscribers can also go back and see what I wrote about any trade and my reasons for entry and exit when it happened.

With a subscription to Quantifiable Edges I try and provide traders with ideas and instruction to improve their trading. These ideas may come in the form of previously published studies identified by the Quantifinder, or they may be something I discuss in the current subscriber letter, or perhaps it's a webinar focused on a certain trading approach or indicator, or any other number of tools that I've designed and made available. (For a more complete list of tools, see the "Using Quantifiable Edges" series of posts.) The trade ideas found in the subscriber letter are examples of how I put these tools and ideas to work. While past performance is not necessarily indicative of future results, over the long run they’ve performed well enough that many subscribers have used them for their benefit.

For more information on a gold subscription, or to subscribe, click here.

Lastly, below is the explanations and disclaimer from the Trade Ideas Results Spreadsheet.

All trade ideas ever tracked in the Quantifiable Edges Subscriber Letter may be found on this spreadsheet. I don’t suggest position sizes. The primary reason for this is I’m not acting as a financial advisor. I don’t feel it is appropriate to suggest allocation sizes without understanding someone’s financial situation and risk tolerance. Even for my own trading I run different portfolios with different levels of aggressiveness. For instance, my most aggressive may use options to sometimes get 300-400% leveraged. Other portfolios on the other hand normally take much more conservative stances and some rarely reach or exceed 100% exposure.

Since I don’t suggest position sizes this is should not be considered a performance report, but rather a trade idea scorecard. Therefore, no matter how objective I try to be the reporting of the results is always going to be skewed depending on how you approach the trades. For instance, I always recommend scaling into the Catapult positions in 3 parts, whereas the “System” trades (whatever system I unveil other than Catapult) are normally one entry. The “Index” trades I normally recommend scaling into as well. For my own trading I trade much larger size with the index trades than any of the individuals. I also control my exposure by limiting the total amount invested per day. As I mentioned, this will vary depending on the account I’m trading. My most aggressive account I may put in up to 100%/day and get heavily leveraged using options. A more conservative account may max out at 15%-20% per day.

It’s unlikely anyone would have taken all of the trades with equal amounts, so personal results would vary greatly depending on the trader’s approach. Simply adding up the results of the individual triggers as I do is an admittedly poor representation of returns. A net positive or negative does not necessarily mean a person following the ideas would have made or lost money during the period measured. And the sum total is certainly not representative of what a portfolio would return.

Feel free to contact me at support @ QuantifiableEdges.com if you have any questions.

As required by the NFA: Except where otherwise specifically stated, all trades are based on hypothetical or simulated trading. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under-or-over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Commissions, fees, and slippage have not been included. This is neither a solicitation to buy/sell securities or listed options.

Thursday, January 5, 2012

Strong Closes for Very Modest Gains

The study below was from the Quantifinder yesterday and was last seen in the 1/26/11 subscriber letter. It suggests that when SPY closes strong (in the top 10% of its range) but still only manages a small gain on the day, that the next day has a downside tendency. Stats are updated.

As you can see, the bearish inclination appears to max out after just 1 day. And while not terribly large, the edge has been fairly consistent over time. Just a little pattern to keep in mind today and in the future…

As you can see, the bearish inclination appears to max out after just 1 day. And while not terribly large, the edge has been fairly consistent over time. Just a little pattern to keep in mind today and in the future…

Tuesday, January 3, 2012

1% Gaps To Start A Month

With futures up over 1.5% as I type pre-market, we’re seeing an unusually large gap up to start the year. Below is a list of the 8 other instances since 2003 that SPY gapped up at least 1% to start the month.

A few notes:

8/2/10 was the only instance that gapped up as much as 1.5%.

Looking out over next several days there was typically a pullback following day 1.

None of the other instances started off the year.

Evidence isn’t overly compelling, but we could see some add-on buying during the day today.

A few notes:

8/2/10 was the only instance that gapped up as much as 1.5%.

Looking out over next several days there was typically a pullback following day 1.

None of the other instances started off the year.

Evidence isn’t overly compelling, but we could see some add-on buying during the day today.

Subscribe to:

Comments (Atom)