I ran some tests to see whether the lower fear levels occurring on a day where the S&P 500 made a substantial low indicated more selling was likely to come. For my tests I used the VXO. The conditions I layed out were 1) The S&P 500 must close at a “x” day closing low. 2) The VXO must close lower than yesterday. 3) The VXO must close at least 10% above its 10-period moving average. The study seemed to indicate that extended VXO levels – even if they were less extended than the day before, had a positive impact on returns over the next week or two.

Below are the results when looking for a 20bar low in the SPX.

The fact that the VXO is stretched appears to be more significant than the fact that it pulled back.

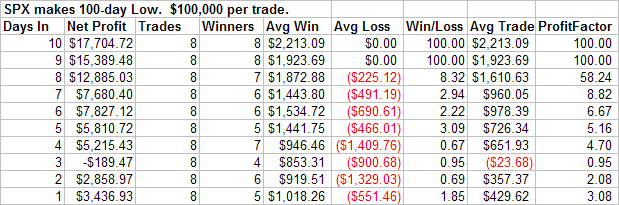

Moving the bar out to a 100 bar low for the SPX gave these results.

In my post on Friday I discussed the high put/call ratios. For some other interesting perspective on these numbers, check out the links below:

Traderfeed - An interesting study and indicator to add to your p/c charts.

Daily Options Report - Some thoughtful musings on p/c related to volatility.

VIX and More - A long term view of the equity p/c ratio.

4 comments:

Rob,

Thanks for the helpful blog. Just to make sure I understand what you've posted here, is this correct:

The 1st table shows the results that occurred when you bought at the open the day following: (a) the SP500 closed at a new 20 day low, (b) the VXO closed lower than yesterday but the VXO was still at least 10% above its 10 day simple moving average.

If true, is your view that the primary message is looking at the relative level of the VXO is more important than the absolute level? And / or that when the VXO gets stretched, it reverts to the mean?

Thanks.

Rob, the low VIX reading does in fact have negative connotations.

I am one of the traders/bloggers who frequently uses the VIX to guage bottoms and tops. I did remark that the low VIX reading after Friday's selloff was a negative as it implied a bottom had not yet been put in.

Using the VIX to measure extreme levels of sentiment, in order to know when to enter or exit, is different from using the VIX and SPX to look out two or three weeks after a particular reading.

Your research does in fact show a negative connotation for a low relative VIX reading as the trades listed do not become profitable unless they are held over 4 days (approximately).

From this I extrapolate that the low VIX means better to wait a few days more before entering the index trades as the market is likely to continue moving against the long position until the capitulation point (with VIX being one factor in measuring capitulation) is hit.

Very helpful and interesting research. I'm curious as to your opinion on my assertion.

I'm sorry, I should have written that the average loss does not become larger than the average win until approximately 4 days later.

Dave,

Yes. The stretched VXO is looked at as a short-term positive for the market. The fact that it failed to rise further on Friday initially concerned me and led me to test it.

Woodshedder's observation is interesting that the avg gain overtakes the avg loss after 4 days. To me the positive winning percentage and overall postive trade expectancy (avg trade) indicates that an edge exists even over the short-term (1-4 days). That edge is not as pronounced as 5-10 days out, but the slight drop in the VXO on Friday appears less important than the fact that it remained stretched.

In other words, I was looking for a reason to dismiss the basic message of the VXO (stretched = market positive). The slight drop on Friday failed to provide me sufficient reason for dismissal.

Thanks to both of both of you for your thoughts.

Rob

Post a Comment