Yesterday I looked at how the S&P has responded following drops of 5% or more. Most often is has led to a bounce. Thursday failed – and in a big way as instead of bouncing it fell another 5%. The only time going back to 1960 that the S&P has fallen 5% for 2 days in a row was during the Crash of 87.

Since my Dow history file goes back to 1920 I decided to look at that. There have been 4 times that the Dow dropped 5% or more 2 days in a row. They were all between 1929 and 1933.

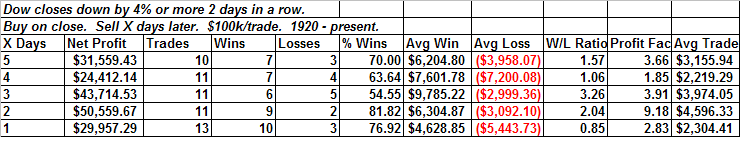

Of course the Dow didn’t drop 5% on Thursday. It did drop over 4%. So I loosened the parameters to 4%. Results below:

Since my Dow history file goes back to 1920 I decided to look at that. There have been 4 times that the Dow dropped 5% or more 2 days in a row. They were all between 1929 and 1933.

Of course the Dow didn’t drop 5% on Thursday. It did drop over 4%. So I loosened the parameters to 4%. Results below:

There appears to be a bullish edge over the 1st two days. After that it dissipates. One of the instances included above was the Crash of 1987. The rest of them all took place between 1929 and 1940.

I can’t even count how many tests I’ve run over the last month whose results came up “1987” or “between 1929 and 1940”.

I can’t even count how many tests I’ve run over the last month whose results came up “1987” or “between 1929 and 1940”.

4 comments:

Rob, can we please get an updated CBI reading or have you decided to stop doing updates? I'm fine with it either way, I never begrudge someone who stops giving away proprietary information.

"After all, gentlemen, we are not communists."

Still zero. I hadn't updated because it hadn't budged. I'll change the date.

I have heard in the last few weeks quite a few folks stating that the Great Depression is simply not comparable to today for this reason or that, and to a certain extent it's true. Today is not yesterday, or 70+ years ago. However, when you simply cannot find comparable circumstances without invocation of this time period, it certainly confirms the simple idea that we really have not been quite this screwed for a long long time.

Excellent work. I enjoy every post.

CBI is still zero. I hadn't updated because it hadn't budged. I'll change the date.

Wow! Two consecutive 5% down days and it couldn't even get to +1???

Post a Comment