The lesson? Sometimes market behaviors change.

Thursday, December 30, 2010

Nasdaq Performance on the Last Day of the Year

A subscriber inquiry brought this changing tendency to my attention and led me to investigate further. Below we see the last day of the year performance for the Nasdaq Composite.

The lesson? Sometimes market behaviors change.

The lesson? Sometimes market behaviors change.

When SPY Closes Near the Bottom of its Range but Still Positive

Yesterday's late selloff was something that many chart readers might view as ugly on a chart. My research has shown quite the opposite. When SPY has closed near the bottom end of its range but still positive on the day that has generally been a good thing. Below is a simple study from last night's Subscriber Letter that exemplifies this.

Even though the number of instances is near the low end of what I prefer the results are strongly suggestive of an upside edge. The profit factor and winning % are especially compelling.

Below is an equity curve using a 3-day exit strategy.

Equity curves don’t get much straighter or more attractive than this. In one of my next few posts I’ll be discussing some of the things I look for in a study that make it compelling. This one has numerous compelling aspects and will act as a nice example.

Even though the number of instances is near the low end of what I prefer the results are strongly suggestive of an upside edge. The profit factor and winning % are especially compelling.

Below is an equity curve using a 3-day exit strategy.

Equity curves don’t get much straighter or more attractive than this. In one of my next few posts I’ll be discussing some of the things I look for in a study that make it compelling. This one has numerous compelling aspects and will act as a nice example.

Thursday, December 23, 2010

Quantifiable Edges Big Time Swing System Overview Page Updated

I’ve updated the Quantifiable Edges Big Time Swing System overview page with results through December 21st. There is not a trade currently open and it’s unlikely we’d see a trade open and close before the end of the year so I figured I might as well do it now. I don’t update results that often since the system only trades about once per month on average. While 2010 was a subpar year, I am pleased to report that on a total of 12 trades it did post a little over a 4% gain.

It’s important not to overreact to a small sample of trades and any single year with this system is a small sample. So I’m not terribly concerned that the performance was subpar. 2010 was marked with moves that were more persistent than usual. Examples would be the March-April rally, the September-October rally and the recent December rally – all of which plugged forward without the sort of oscillations that are typically seen. For the Big Time Swing, which often looks to play oscillations, this meant some extended sidelined periods. There has only been 1 trade in the 4th quarter.

Profits were also cut in half thanks to a few positions that signaled an exit for the next morning. Exits can be taken at the close or the next day’s open. Historical analysis has shown an edge in holding certain trades overnight after the exit is triggered. Doing so in 2010 would have cost about 4%, so this did cause me some frustration. Still, I’m not inclined to change my approach due to a small number of unfortunate overnight moves. Of course since it is an open system traders have the option of tweaking it any way they want.

For those looking for a system that they can use as a base to build their own system from, the Big Time Swing is an attractive option. It is all open-coded and comes complete with a substantial amount of background historical research. And since it is only in the market about ¼ of the time, it can easily be combined with other systems to provide greater opportunities. Once you’re ready to try and improve the system yourself you can also refer to the system manual or the August 2010 purchaser-only webinar – both of which discuss numerous ideas for customization.

And if system development isn’t your thing, the Big Time Swing System provides easy to follow mechanical rules that you can follow. The standard parameters have performed quite well. There are only about 12 trades per year averaging 7 trading days per trade. All entries and exits are either at the open or the close. And to be sure you have everything set up properly traders may follow the private-purchasers only blog that shows all SPY signals and possible entry/exit levels. This service is free for 12 months from the date of purchase.

For more information and to see the updated overview sheet, click here.

If you’d like additional information about the system, or have questions, you may email BigTimeSwing @ Quantifiable Edges.com (no spaces).

It’s important not to overreact to a small sample of trades and any single year with this system is a small sample. So I’m not terribly concerned that the performance was subpar. 2010 was marked with moves that were more persistent than usual. Examples would be the March-April rally, the September-October rally and the recent December rally – all of which plugged forward without the sort of oscillations that are typically seen. For the Big Time Swing, which often looks to play oscillations, this meant some extended sidelined periods. There has only been 1 trade in the 4th quarter.

Profits were also cut in half thanks to a few positions that signaled an exit for the next morning. Exits can be taken at the close or the next day’s open. Historical analysis has shown an edge in holding certain trades overnight after the exit is triggered. Doing so in 2010 would have cost about 4%, so this did cause me some frustration. Still, I’m not inclined to change my approach due to a small number of unfortunate overnight moves. Of course since it is an open system traders have the option of tweaking it any way they want.

For those looking for a system that they can use as a base to build their own system from, the Big Time Swing is an attractive option. It is all open-coded and comes complete with a substantial amount of background historical research. And since it is only in the market about ¼ of the time, it can easily be combined with other systems to provide greater opportunities. Once you’re ready to try and improve the system yourself you can also refer to the system manual or the August 2010 purchaser-only webinar – both of which discuss numerous ideas for customization.

And if system development isn’t your thing, the Big Time Swing System provides easy to follow mechanical rules that you can follow. The standard parameters have performed quite well. There are only about 12 trades per year averaging 7 trading days per trade. All entries and exits are either at the open or the close. And to be sure you have everything set up properly traders may follow the private-purchasers only blog that shows all SPY signals and possible entry/exit levels. This service is free for 12 months from the date of purchase.

For more information and to see the updated overview sheet, click here.

If you’d like additional information about the system, or have questions, you may email BigTimeSwing @ Quantifiable Edges.com (no spaces).

Wednesday, December 22, 2010

'Twas 3 Nights Before Christmas (Updated)

Tuesday's close brought us to the next extremely strong seasonal period. The last 2 years I have shown the "Twas 3 Nights Before Christmas" study. I've have updated it again below.

Results continue to look strong. A close above the entry at some point in the next 5 days has been a near certainty since 1987.

Results continue to look strong. A close above the entry at some point in the next 5 days has been a near certainty since 1987.

Friday, December 17, 2010

How many instances are needed when considering study results?

This post is the 2nd part of a series I started a few weeks ago that will discuss using quantifiable edges to your advantage. Today I'll discuss a common question I get about the studies. How many instances are needed for valid and usable results? It will lead into "What makes a study compelling?" in the next post.

Many of the posts I put on the blog are what I refer to as studies. In this previous post I showed the layout of the studies. A study is simply test results of an idea. Most of the time the idea is based in technical analysis. It looks to answer the question, “How has the market performed in the past after…”

Some studies are fairly general. For instance, I might look at how the market performs after it has traded down 3 days in a row. Others are more specific with added filters. Perhaps I notice that not only is the SPX down 3 days in a row, but it also is trading at a 10-day low, and is above the 200ma and volume has increased each of the last 3 days.

Both studies could tell me something about the market in relation to its current condition (assuming I’m describing current conditions, which is typically my approach). If I am able to describe conditions that more closely match the current market then I have a better shot at seeing behavior over the next several days match up with the study results. Of course there is a trade-off between general and specific, and that is the number of instances.

A general test may have hundreds or thousands of instances which it can refer to in order to generate expectations. A very specific test may have an extremely low number of instances. If the number of instances is too low then the results may have little or no meaning. For instance if my parameters are run and I find that the market had only set up in a similar manner 1 other time over my test period, is it reasonable to assume that the market will act the same way this time? Most people would correctly assume “no”. What if there were 2 instances and they both had similar reactions in the past. Could I assume this suggests a directional edge? 3 instances? 4? 10? 30? 50? More? How many instances is “enough” to have some level of confidence that your results are actually suggesting an edge and they are not the result of luck?

Before answering let me address 1 common misconception people have about statistical testing. That misconception is that you need 30 instances in order to demonstrate statistical significance. This idea originates in the fact that a sample size of 30 is needed in order to calculate a Z-score or run a chi-square test. The reason that 30 instances are necessary is that Z-scores assume a normal probability distribution. Without 30 instances it is not possible to resolve the shape of the normal probability distribution clearly enough to make certain statistical measures valid. One thing traders should be aware of is that the stock market does not have a normal distribution anyway. It has “fat tails”. In other words, there are more outliers present in stock market movements than one would expect under a normally distributed curve. So relying on standard statistical measures and assuming a normal distribution could expose a trader to more risk than his results would imply.

Still, these tests are helpful in determining whether your results were likely due to a real edge or whether there is a high risk that luck played a big part. But what if you don’t have 30 instances? In that case you could use a t-table statistic.

To better understand statistical significance and see how to run some of these tests I’ll refer you to the below post from a couple of years back:

http://quantifiableedges.blogspot.com/2008/05/significance.html

Note that this post also contains a t-table. One interesting thing we can see when looking at a t-table is the minimum number of instances you would need to have different confidence levels that your edge is actually an edge and not due to luck. For instance, if all instances were followed by a market rise, you would want at least 6 instances in order to be 95% confident that there was an actual edge. A 99.9% confidence would be reached if you had 11 instances that all resulted in a rise over the next X days.

So if you look back at the study I showed Wednesday, SPY only set up in that pattern 12 times in the past, but every time it was trading higher 5 days later. This means statistically there is about a 99.9% chance that the positive results were due to more than luck. That there has in fact been a real edge in that pattern in the past. Does this mean there is a 100% chance it will be higher 5 days after the setup? No! Not even close. A high degree of confidence means there is likely some kind of an edge. It doesn’t mean the past winning % or net expectations are likely to persist indefinitely.

So how many instances do I require before I’m willing to accept a study as part of my analysis and place it on my active list? It varies depending on things like the strength of previous reactions and other stats I’ll get into in my next post, but I’ll generally use a t-table to help me decide. Will I incorporate a study with only 10 or 11 instances? Yes, but it will have to have strong win/loss stats and a high win %. Personally, I tend to favor studies that have somewhere between 20-70 instances. Too low and they are less reliable. Too high and the setup is often too broad to have much meaning.

I’ve spent far more space discussing this than I wanted, but it is an issue that has come up time and again with readers, so I wanted to be somewhat thorough.

In fact, of the list of things I look at in a study to help me decide whether it is compelling or not, the number of instances (assuming it isn’t minuscule) is near the bottom .

I intend to accelerate this series of posts over the next couple of weeks and I’m sorry it’s taken so long to get rolling. In the next post I will discuss a list of other things I examine when determining whether I find a study compelling.

Many of the posts I put on the blog are what I refer to as studies. In this previous post I showed the layout of the studies. A study is simply test results of an idea. Most of the time the idea is based in technical analysis. It looks to answer the question, “How has the market performed in the past after…”

Some studies are fairly general. For instance, I might look at how the market performs after it has traded down 3 days in a row. Others are more specific with added filters. Perhaps I notice that not only is the SPX down 3 days in a row, but it also is trading at a 10-day low, and is above the 200ma and volume has increased each of the last 3 days.

Both studies could tell me something about the market in relation to its current condition (assuming I’m describing current conditions, which is typically my approach). If I am able to describe conditions that more closely match the current market then I have a better shot at seeing behavior over the next several days match up with the study results. Of course there is a trade-off between general and specific, and that is the number of instances.

A general test may have hundreds or thousands of instances which it can refer to in order to generate expectations. A very specific test may have an extremely low number of instances. If the number of instances is too low then the results may have little or no meaning. For instance if my parameters are run and I find that the market had only set up in a similar manner 1 other time over my test period, is it reasonable to assume that the market will act the same way this time? Most people would correctly assume “no”. What if there were 2 instances and they both had similar reactions in the past. Could I assume this suggests a directional edge? 3 instances? 4? 10? 30? 50? More? How many instances is “enough” to have some level of confidence that your results are actually suggesting an edge and they are not the result of luck?

Before answering let me address 1 common misconception people have about statistical testing. That misconception is that you need 30 instances in order to demonstrate statistical significance. This idea originates in the fact that a sample size of 30 is needed in order to calculate a Z-score or run a chi-square test. The reason that 30 instances are necessary is that Z-scores assume a normal probability distribution. Without 30 instances it is not possible to resolve the shape of the normal probability distribution clearly enough to make certain statistical measures valid. One thing traders should be aware of is that the stock market does not have a normal distribution anyway. It has “fat tails”. In other words, there are more outliers present in stock market movements than one would expect under a normally distributed curve. So relying on standard statistical measures and assuming a normal distribution could expose a trader to more risk than his results would imply.

Still, these tests are helpful in determining whether your results were likely due to a real edge or whether there is a high risk that luck played a big part. But what if you don’t have 30 instances? In that case you could use a t-table statistic.

To better understand statistical significance and see how to run some of these tests I’ll refer you to the below post from a couple of years back:

http://quantifiableedges.blogspot.com/2008/05/significance.html

Note that this post also contains a t-table. One interesting thing we can see when looking at a t-table is the minimum number of instances you would need to have different confidence levels that your edge is actually an edge and not due to luck. For instance, if all instances were followed by a market rise, you would want at least 6 instances in order to be 95% confident that there was an actual edge. A 99.9% confidence would be reached if you had 11 instances that all resulted in a rise over the next X days.

So if you look back at the study I showed Wednesday, SPY only set up in that pattern 12 times in the past, but every time it was trading higher 5 days later. This means statistically there is about a 99.9% chance that the positive results were due to more than luck. That there has in fact been a real edge in that pattern in the past. Does this mean there is a 100% chance it will be higher 5 days after the setup? No! Not even close. A high degree of confidence means there is likely some kind of an edge. It doesn’t mean the past winning % or net expectations are likely to persist indefinitely.

So how many instances do I require before I’m willing to accept a study as part of my analysis and place it on my active list? It varies depending on things like the strength of previous reactions and other stats I’ll get into in my next post, but I’ll generally use a t-table to help me decide. Will I incorporate a study with only 10 or 11 instances? Yes, but it will have to have strong win/loss stats and a high win %. Personally, I tend to favor studies that have somewhere between 20-70 instances. Too low and they are less reliable. Too high and the setup is often too broad to have much meaning.

I’ve spent far more space discussing this than I wanted, but it is an issue that has come up time and again with readers, so I wanted to be somewhat thorough.

In fact, of the list of things I look at in a study to help me decide whether it is compelling or not, the number of instances (assuming it isn’t minuscule) is near the bottom .

I intend to accelerate this series of posts over the next couple of weeks and I’m sorry it’s taken so long to get rolling. In the next post I will discuss a list of other things I examine when determining whether I find a study compelling.

Wednesday, December 15, 2010

A Rare SPY Pattern That Has Always Been Followed by Short Term Gains

The pattern of the last 2 days is quite interesting. Both days we saw a gap higher, a move up above the previous day’s high, and then a reversal that led the SPY to close below its open but still in positive territory. I looked at this 2-day setup in the subscriber letter in March using a long-term trend filter. I have updated the study below.

Only 12 instances but the results are overwhelmingly positive. In last night's Subscriber Letter I shared some additional details, including all the dates. There are actually a very large number of studies I am currently monitoring. They are somewhat mixed. This particular study makes a compelling arguement for a short-term bullish outlook. If you'd like to trial the Quantifiable Edges Subscriber Letter a free trial is offered here. If you have already trialed it but not in the last 6 months, you may request another trial via email to support at QuantifiableEdges dot com.

Only 12 instances but the results are overwhelmingly positive. In last night's Subscriber Letter I shared some additional details, including all the dates. There are actually a very large number of studies I am currently monitoring. They are somewhat mixed. This particular study makes a compelling arguement for a short-term bullish outlook. If you'd like to trial the Quantifiable Edges Subscriber Letter a free trial is offered here. If you have already trialed it but not in the last 6 months, you may request another trial via email to support at QuantifiableEdges dot com.

Monday, December 13, 2010

I'll Be Speaking at the Traders Expo in New York in February

The Traders Expo will be held at the Marriot Marquis Hotel in from February 20 - 23, 2011. I've decided to make the trip.

I'll be speaking on the 21st from 1:30 - 2:30pm. I'll be discussing some of of my favorite research and trading ideas. I hope to have the opportunity to meet severall blog readers and subscribers at the event.

I'll send out another reminder as we get closer. Registration is free and you may sign up using the link below:

https://secure.moneyshow.com/msc/nyot/registration.asp?sid=nyot11&scode=020867

I'll be speaking on the 21st from 1:30 - 2:30pm. I'll be discussing some of of my favorite research and trading ideas. I hope to have the opportunity to meet severall blog readers and subscribers at the event.

I'll send out another reminder as we get closer. Registration is free and you may sign up using the link below:

https://secure.moneyshow.com/msc/nyot/registration.asp?sid=nyot11&scode=020867

Sunday, December 12, 2010

The Most Wonderful Tiiiime of the Yearrrrrr!

Over several time horizons op-ex week in December has been the most bullish week of the year for the SPX. The positive seasonality actually has persisted for up to 3 weeks. I demonstrated this last year in the 12/14/09 blog. I’ve updated that study below to include 2009 stats.

Last year saw the market move higher on Monday and then pull back the rest of the week before rallying into year-end.

I'm generally seeing a mix of bullish and bearish studies right now. Friday's blog is an example of an active bearish study. This one certainly favors the bulls.

Last year saw the market move higher on Monday and then pull back the rest of the week before rallying into year-end.

I'm generally seeing a mix of bullish and bearish studies right now. Friday's blog is an example of an active bearish study. This one certainly favors the bulls.

Friday, December 10, 2010

SPY Consecutive 50-day Highs On Lower Volume

Declining volume at new highs can often lead to short-term difficulties. Below is a study related to SPY and SPY volume that I've shown a few times in the Subscriber Letter. It popped up in the Quantifinder again on Thursday.

This appears to suggest a mild downside edge. The high probability of some kind of decline despite the fact that it always occurs in an intermediate-term uptrend makes the study compelling enough to me to take under consideration.

This appears to suggest a mild downside edge. The high probability of some kind of decline despite the fact that it always occurs in an intermediate-term uptrend makes the study compelling enough to me to take under consideration.

Tuesday, December 7, 2010

Large Gap to New Highs Not the Edge They Once Were?

I've shown in the past using numerous studies that a large gap to a new high has a tendency to pull back during the day. Below is a study that represents some of what I was looking at this morning.

The stats here appear quite bearish. But below is the equity curve.

It appears over the last few years this setup has failed to deliver consistent downside movement. I looked at this a number of ways this morning and most of the equity curves looked like this. So be careful getting overcondfident trying to short this gap.

The stats here appear quite bearish. But below is the equity curve.

It appears over the last few years this setup has failed to deliver consistent downside movement. I looked at this a number of ways this morning and most of the equity curves looked like this. So be careful getting overcondfident trying to short this gap.

Monday, December 6, 2010

POMO Stimulus Indicator At New High and Still Climbing

Last week on the blog I showed an indicator that measured the amount of POMO stimulus the Fed has injected into the system over a 1-month (20 day) timeframe. As a review POMO stands for Permanent Open Market Operations and it is how the Fed goes into the open market to buy (or sell) treasury securities. The net effect of this buying is an influx of cash into the system. It appears a portion of that cash makes its way through the banking system and into the stock market. It also appears that the net effect of all this Fed buying is a positive influence on the stock market.

Today I have updated the chart from last week. The top panel shows the S&P 500. The indicator on the bottom is the total POMO buying in dollars that the Fed has done. I've zoomed in to just show the last year and a half.

As you can see the POMO buying over the last month has now far exceeded any 20-day period in 2009 (or ever). According to the Fed's website Mon-Thurs of this week are also scheduled for POMO activity. And a new schedule is due out on Friday so there is a chance we'll continue to see strong Fed buying in the weeks ahead. Evidence suggests to me that this should have a bullish influence on the market.

Wednesday, December 1, 2010

Large Gaps Up on the 1st Day of the Month

Last night in his video "Gap Guy" Scott Andrews took some interesting looks at gaps that occured on the 1st day of the month. Of course since he posted it early he couldn't have known we were about to get such a large gap up. Inspired by Scott I took a look at other 1% gaps that occured on the 1st day of the month. I've listed all instances below.

Tuesday, November 30, 2010

1-Month POMO Stimulus Level Set To Hit Record Highs

Over the last few weeks in the Quantifiable Edges Subscriber Letter I’ve posted a number of studies related to Fed POMO activity. I’m not the first to look at POMO. It is a topic I first saw on Zerohedge and have seen discussed many other places since. For those unaware POMO stands for Permanent Open Market Operations and it is how the Fed goes into the open market to buy (or sell) treasury securities. The net effect of this buying is an influx of cash into the system. It appears a portion of that cash makes its way through the banking system and into the stock market. It also appears that the net effect of all this Fed buying is a positive influence on the stock market. Conversely, when the Fed sells securities in the open market then it is pulling money from the system. This appears to have a possible negative influence on the stock market.

The chart below is of the S&P 500 since August of 2005 (as far back as the Fed’s POMO Database goes). The indicator on the bottom of the chart shows the total amount that the Fed either pumped into or withdrew from the system through POMO activity over the last month. (Running 20-day total par accepted.)

(CLICK CHART TO ENLARGE)

Note how the market has performed in accordance with past POMO activity. According to the Fed’s website, they are tentatively slated to perform buying every trading day from now through December 9th. Either Tuesday or Wednesday we should see the 20-day running total as shown on the bottom indicator exceed the highest levels in 2009. Based on the above chart, (and a number of studies I’ve conducted) it appears the old adage “Don’t fight the Fed” still holds true. If this is the case, then the Fed’s recent and scheduled activity should act as a bullish influence in the days and weeks to come.

The chart below is of the S&P 500 since August of 2005 (as far back as the Fed’s POMO Database goes). The indicator on the bottom of the chart shows the total amount that the Fed either pumped into or withdrew from the system through POMO activity over the last month. (Running 20-day total par accepted.)

(CLICK CHART TO ENLARGE)

Note how the market has performed in accordance with past POMO activity. According to the Fed’s website, they are tentatively slated to perform buying every trading day from now through December 9th. Either Tuesday or Wednesday we should see the 20-day running total as shown on the bottom indicator exceed the highest levels in 2009. Based on the above chart, (and a number of studies I’ve conducted) it appears the old adage “Don’t fight the Fed” still holds true. If this is the case, then the Fed’s recent and scheduled activity should act as a bullish influence in the days and weeks to come.

Wednesday, November 24, 2010

When Monday & Tuesday of Thanksgiving Week Are Lower

As I showed a few days ago Thanksgiving week has had some very bullish tendencies on both Wednesday and Friday. Interesting about the current week is that both Monday and Tuesday have closed down in the SPX. Going back to 1961 I looked at performance on Wed through Fri after Mon and Tues were lower. There were only eight other instances. They are listed below.

Instances are lower than I would prefer but stats are heavily lopsided to the short-term bullish case.

Happy Thanksgiving!

Instances are lower than I would prefer but stats are heavily lopsided to the short-term bullish case.

Happy Thanksgiving!

Monday, November 22, 2010

Thanksgiving Week Tendencies Revisited

Historically Thanksgiving week has shown some very strong tendencies. Last year in the 11/23/09 blog I broke down the returns by day of the week. I have updated that table below.

Monday and Tuesday before Thanksgiving don’t seem to carry a sizable edge. Monday’s total return was actually negative until 2008 when it posted a gain of over 6%. Wednesday and Friday surrounding Thanksgiving have shown strong upside tendencies and the Monday after has shown a sizable downside tendency.

Monday and Tuesday before Thanksgiving don’t seem to carry a sizable edge. Monday’s total return was actually negative until 2008 when it posted a gain of over 6%. Wednesday and Friday surrounding Thanksgiving have shown strong upside tendencies and the Monday after has shown a sizable downside tendency.

Thursday, November 18, 2010

Using Quantifiable Edges to Your Advantage - Part 1 - Understanding the Study Layout

This post is the beginning in a series which will provide readers some ideas on how they can take some of the edges they see here (and elsewhere) and use them to their advantage in their own trading.

Before getting into a theoretical discussion it’s important that I make sure everyone understands what it is I’m presenting when I show these studies in the blog and the Subscriber Letter. Over time I have pretty much standardized the statistics that I show in my tables. I have tried to strike a balance between giving enough information to make the table useful and giving too much information which could make it messy and confusing. Below is a sample study (with real results but a bogus description). I’ll use this as an example to refer to.

The top box of the study always lays out the conditions. Everything that was taken into account is described there. One thing to note is that I always run the studies on $100k/trade. This is because most of them look at the S&P 500. Since it trades at about 1,200 there will always be some leftover when buying into a portfolio (you can’t buy a half a share in Tradestation). The $100k makes the rounding error small enough so that it doesn’t have much of an affect. $10,000 would have too large of a rounding error. $1,000,000 would be better but then the numbers get so large it makes it more difficult to read.

With an even $100k I find the results easy to interpret. $1000 = 1% in the results columns. So in the above example the “Average Trade” shows a gain of $733 after 3 days. This is almost 0.75%.

Now let’s briefly review each column in the results table.

“X Days” – Most tests I run out over a number of days to see how the market has performed after the test conditions were in place. “X Days” just shows the length of time from the entry. The entry is normally assumed to take place at the close. The exits are also assumed to be at the close. The number of days refers to trading days – not calendar days. Note this column reads from the bottom up, which means all columns do. No reason for that. It’s just how I started doing it a long time ago.

“Net Profit” – This is the net gain or loss for the entire sample of instances included in the study. One thing to note is that I always “Buy” the setup. This is not because I am only looking for long edges. It is because it makes the table easier to read. A quick glance can tell me if the edge is bullish or bearish. Lots of positive, green numbers is bullish. Lots of negative, red numbers is bearish. A long time ago I would sometimes set the entry condition to “short” at the close. Then I could see profits from shorting. Doing this required me to read the entry conditions carefully and would occasionally lead to some confusion when I didn’t. So for purposes of easily reading the study tables, everything assumes a long position.

“Total Trades” – This is the total number of instances that triggered based on the study conditions. As in the case above, this number will sometimes be larger for Day 1 and then you’ll see a declining number of instances as you look further out. If you’re wondering why this happens, check out the June 18, 2010 blog post.

“Winning Trades” – The total number of trades that were showing a gain “X Days” later.

“Losing Trades” – The total number of trades showing a loss “X Days” later. The wining plus the losing trades typically add up to the total trades. In those rare instances when it doesn’t it means a trade was breakeven on that day.

“% Profitable” – This column simply shows the winners / total trades. Sometimes a 50% profitable situation can still show a strong edge. That would mean gains outsized losses by a large degree (or vice-versa). % profitable is important from a trading standpoint though. If a setup is 90% profitable it is generally less likely to put you through an extended drawdown as a setup that is 55% profitable with the same size average trade.

“Avg Winning Trade” – This looks at all the “winning trades” and divides them by the gross profits on those trades. (Gross gain and gross loss columns are not shown.) So in the table above, the “Avg Winning Trade” was up $692 after day 1. This means that of the 14 instances that finished higher the next day, the average gained just under 0.7%.

“Avg Losing Trade” – Just like “Avg Winning Trade”, but it is looking just at the losers. In this case after day 1, the 7 losers dropped about 0.9% on average.

“Win/Loss Ratio” – This takes the value from the “Avg Winning Trade” column and divides by the value from the “Avg Losing Trade” column. It can help you determine whether the reaction was typically more explosive on moves up or down.

“Profit Factor” – This is the stat I am asked about the most. It is a stat often cited by system traders. Profit Factor = Gross Gains / Gross Losses. Profit factors above 1 occur when there are positive net results and below 1 occurs when there are negative net results from a study. When thinking about the importance of profit factor, it is easiest to consider how 2 systems may compare. Consider 2 systems made a hypothetical $10,000 each over a specified time period. System 1 had $15,000 in gains and $5,000 in losses. Its profit factor was 3. (15k/5k = 3). System 2 also made $10,000 but it was on $100,000 in gains and $90,000 in losses. Its profit factor was 1.11 (100/90). Most people would find system 1 more appealing as it seemed to make the $10,000 with less effort and risk.

“Avg Trade” – This is simply the net gains divided by the total trades. Under most circumstances, I’ll use the information in this column to help generate estimates.

Last but not least I will often place a statement with additional information in a box below the results. This is typically information that can’t be seen in the table. A common bit of information I put here is how often the market might close up (or down) from the entry price at some point in the next few days.

In the next installment of this series I’ll give a brief discussion of attributes that would make a study compelling to me and entice me to incorporate it in formulating my market bias.

Before getting into a theoretical discussion it’s important that I make sure everyone understands what it is I’m presenting when I show these studies in the blog and the Subscriber Letter. Over time I have pretty much standardized the statistics that I show in my tables. I have tried to strike a balance between giving enough information to make the table useful and giving too much information which could make it messy and confusing. Below is a sample study (with real results but a bogus description). I’ll use this as an example to refer to.

The top box of the study always lays out the conditions. Everything that was taken into account is described there. One thing to note is that I always run the studies on $100k/trade. This is because most of them look at the S&P 500. Since it trades at about 1,200 there will always be some leftover when buying into a portfolio (you can’t buy a half a share in Tradestation). The $100k makes the rounding error small enough so that it doesn’t have much of an affect. $10,000 would have too large of a rounding error. $1,000,000 would be better but then the numbers get so large it makes it more difficult to read.

With an even $100k I find the results easy to interpret. $1000 = 1% in the results columns. So in the above example the “Average Trade” shows a gain of $733 after 3 days. This is almost 0.75%.

Now let’s briefly review each column in the results table.

“X Days” – Most tests I run out over a number of days to see how the market has performed after the test conditions were in place. “X Days” just shows the length of time from the entry. The entry is normally assumed to take place at the close. The exits are also assumed to be at the close. The number of days refers to trading days – not calendar days. Note this column reads from the bottom up, which means all columns do. No reason for that. It’s just how I started doing it a long time ago.

“Net Profit” – This is the net gain or loss for the entire sample of instances included in the study. One thing to note is that I always “Buy” the setup. This is not because I am only looking for long edges. It is because it makes the table easier to read. A quick glance can tell me if the edge is bullish or bearish. Lots of positive, green numbers is bullish. Lots of negative, red numbers is bearish. A long time ago I would sometimes set the entry condition to “short” at the close. Then I could see profits from shorting. Doing this required me to read the entry conditions carefully and would occasionally lead to some confusion when I didn’t. So for purposes of easily reading the study tables, everything assumes a long position.

“Total Trades” – This is the total number of instances that triggered based on the study conditions. As in the case above, this number will sometimes be larger for Day 1 and then you’ll see a declining number of instances as you look further out. If you’re wondering why this happens, check out the June 18, 2010 blog post.

“Winning Trades” – The total number of trades that were showing a gain “X Days” later.

“Losing Trades” – The total number of trades showing a loss “X Days” later. The wining plus the losing trades typically add up to the total trades. In those rare instances when it doesn’t it means a trade was breakeven on that day.

“% Profitable” – This column simply shows the winners / total trades. Sometimes a 50% profitable situation can still show a strong edge. That would mean gains outsized losses by a large degree (or vice-versa). % profitable is important from a trading standpoint though. If a setup is 90% profitable it is generally less likely to put you through an extended drawdown as a setup that is 55% profitable with the same size average trade.

“Avg Winning Trade” – This looks at all the “winning trades” and divides them by the gross profits on those trades. (Gross gain and gross loss columns are not shown.) So in the table above, the “Avg Winning Trade” was up $692 after day 1. This means that of the 14 instances that finished higher the next day, the average gained just under 0.7%.

“Avg Losing Trade” – Just like “Avg Winning Trade”, but it is looking just at the losers. In this case after day 1, the 7 losers dropped about 0.9% on average.

“Win/Loss Ratio” – This takes the value from the “Avg Winning Trade” column and divides by the value from the “Avg Losing Trade” column. It can help you determine whether the reaction was typically more explosive on moves up or down.

“Profit Factor” – This is the stat I am asked about the most. It is a stat often cited by system traders. Profit Factor = Gross Gains / Gross Losses. Profit factors above 1 occur when there are positive net results and below 1 occurs when there are negative net results from a study. When thinking about the importance of profit factor, it is easiest to consider how 2 systems may compare. Consider 2 systems made a hypothetical $10,000 each over a specified time period. System 1 had $15,000 in gains and $5,000 in losses. Its profit factor was 3. (15k/5k = 3). System 2 also made $10,000 but it was on $100,000 in gains and $90,000 in losses. Its profit factor was 1.11 (100/90). Most people would find system 1 more appealing as it seemed to make the $10,000 with less effort and risk.

“Avg Trade” – This is simply the net gains divided by the total trades. Under most circumstances, I’ll use the information in this column to help generate estimates.

Last but not least I will often place a statement with additional information in a box below the results. This is typically information that can’t be seen in the table. A common bit of information I put here is how often the market might close up (or down) from the entry price at some point in the next few days.

In the next installment of this series I’ll give a brief discussion of attributes that would make a study compelling to me and entice me to incorporate it in formulating my market bias.

Monday, November 15, 2010

A Very Powerful QQQQ Pattern

When a short-term decline that is already a bit overdone experiences a downside acceleration it will often mean an upside reversal is ready to occur. QQQQ's current pattern is showing a potentially powerful example.

These very simple requirements have led to some very strong results, both short and intermediate-term. Four weeks out the average trade has produced a gain in the QQQQ of over 10%. Even if this apparent upside edge does play out, I don’t expect to see gains this strong over the next month. Often the outsized gains were partially due to the volatile environment that was present when the study triggered. Many of these occurred during the wild 2000 – 2002 bear market in the Nasdaq. The current environment is carrying low volatility, so my expectations are dampened.

This downside acceleration concept is one I've found useful before. It is included in a few of the systems available with a Quantifiable Edges Gold Subscription. More details on the above study (and others) are available in last night's Subscriber Letter. Click here for a free trial.

These very simple requirements have led to some very strong results, both short and intermediate-term. Four weeks out the average trade has produced a gain in the QQQQ of over 10%. Even if this apparent upside edge does play out, I don’t expect to see gains this strong over the next month. Often the outsized gains were partially due to the volatile environment that was present when the study triggered. Many of these occurred during the wild 2000 – 2002 bear market in the Nasdaq. The current environment is carrying low volatility, so my expectations are dampened.

This downside acceleration concept is one I've found useful before. It is included in a few of the systems available with a Quantifiable Edges Gold Subscription. More details on the above study (and others) are available in last night's Subscriber Letter. Click here for a free trial.

Friday, November 12, 2010

Why The Equity Curve Is Importnat In Evaluating Studies

While I don't always show it I do always look at the equity curve when evaluating studies to include in my analysis. Last night while conducting my research I came across a great example of why this is important.

Inside days have generally suggested a bearish edge when the market is below the 200ma and no edge much better than upside drift when above the 200ma. I found it unusual that the inside day came with an unfilled gap down so I tested the possible effects under these circumstances.

Base on this the next 1-3 days would seem to have a bearish inclination. But here is a picture of the equity curve.

Inside days have generally suggested a bearish edge when the market is below the 200ma and no edge much better than upside drift when above the 200ma. I found it unusual that the inside day came with an unfilled gap down so I tested the possible effects under these circumstances.

At first glance the numbers seemed to suggest a downside edge. A closer look showed the numbers to be misleading. Here are the results in table format.

As you can see it has been a long time since this setup has produced compelling odds. Researchers should always take a look at the equity curve when considering whether to incorporate results into their analysis.

Another blogger who often makes this point is Michael Stokes of MarketSci. He did it again in his recent Thanksgiving returns post yesterday.

Wednesday, November 10, 2010

Back to Back Outside Days in QQQQ Revisited

Yesterday afternoon the Quantifinder identified an interesting study that I last wrote about in the 3/23/10 blog. It looked at back to back outside days in QQQQ. I’ve updated the study below.

I also sliced this a few different ways (above/below 200ma, up/down close, etc.) and found little difference in the results. Despite the low number of instances I find this a compelling setup. You'll also note that on December 7, 2009 I performed the same study on SPY and found compelling results there as well.

I also sliced this a few different ways (above/below 200ma, up/down close, etc.) and found little difference in the results. Despite the low number of instances I find this a compelling setup. You'll also note that on December 7, 2009 I performed the same study on SPY and found compelling results there as well.

Monday, November 8, 2010

Overbought in an Uptrend

Most swing traders understand that the market has a tendency to oscillate. In other words, strongly oversold conditions will often lead to a bounce and strongly overbought conditions will often lead to a pullback. The trick in trading a swing time frame is understanding when the likelihood to reverse is strong and when it isn’t.

Trying to sell short when an uptrend gets overbought can be a dangerous endeavor. Often there will be no downside edge when trying to short into an overbought condition in an uptrend. When the market is strongly overbought due to a sharp acceleration in the trend as occurred late last week, it may even suggest an upside edge. Below is a study from last night’s subscriber letter that demonstrates this.

We see here a mild upside edge.

Actually the upside stretch is even more extreme that I show in this study. There were some momentum studies in last night’s letter suggesting an even greater bullish edge. There are also a few active studies that suggest a mild pullback could be in order. In any case, the point is that though the market is short-term overbought, this is by no means an ideal short setup. And in general odds seem to favor a continuation rather than a strong, immediate drop.

Trying to sell short when an uptrend gets overbought can be a dangerous endeavor. Often there will be no downside edge when trying to short into an overbought condition in an uptrend. When the market is strongly overbought due to a sharp acceleration in the trend as occurred late last week, it may even suggest an upside edge. Below is a study from last night’s subscriber letter that demonstrates this.

We see here a mild upside edge.

Actually the upside stretch is even more extreme that I show in this study. There were some momentum studies in last night’s letter suggesting an even greater bullish edge. There are also a few active studies that suggest a mild pullback could be in order. In any case, the point is that though the market is short-term overbought, this is by no means an ideal short setup. And in general odds seem to favor a continuation rather than a strong, immediate drop.

Friday, November 5, 2010

The Importance of Breadth & Volume Confirming A Move To New Highs

While we can learn a lot from price action, it really only gives a small piece of what the market is doing. There are many other forces that play a role in determining the likelihood of future price movement. Breadth and volume are 2 that I mention every night in the Subscriber Letter.

Moves to new highs are often followed by brief retracements. This has especially been true since around the year 2000. (This is when chop became favored over day to day trending activity as discussed here.) In last night's letter I showed a study that suggested strong breadth and volume in conjunction with a new high has favored further short-term upside. That study is below.

Instances are a bit low but results are fairly compelling. I did run the results back further last night and found the edge has been present as far back as the 1970s. It became stronger after 1988.

Now let's look at what has happened since 2000 when these new highs were not accompanied by strong breadth and volume.

The difference is striking. This is just another reminder that price action alone does not tell the whole story.

Moves to new highs are often followed by brief retracements. This has especially been true since around the year 2000. (This is when chop became favored over day to day trending activity as discussed here.) In last night's letter I showed a study that suggested strong breadth and volume in conjunction with a new high has favored further short-term upside. That study is below.

Instances are a bit low but results are fairly compelling. I did run the results back further last night and found the edge has been present as far back as the 1970s. It became stronger after 1988.

Now let's look at what has happened since 2000 when these new highs were not accompanied by strong breadth and volume.

The difference is striking. This is just another reminder that price action alone does not tell the whole story.

Wednesday, November 3, 2010

Fed Days With The Market At An Intermediate-Term High

Fed Days have generally exhibited an upside bias for about 30 years. Many times this has been thanks to the Fed giving a confidence boost to a struggling market. But what of those times where the market is already at an intermediate-term high. With the SPX closing at a new rally high yesterday this is the situation the market is now in. Below is a study that take a look.

What I see here is that there has been no tendency for the market to advance under these circumstances. There could even be a slight downside edge, but the numbers aren’t compelling enough for me to bank on that. I’d simply view it as neutral.

What I see here is that there has been no tendency for the market to advance under these circumstances. There could even be a slight downside edge, but the numbers aren’t compelling enough for me to bank on that. I’d simply view it as neutral.

Tuesday, November 2, 2010

Fed Day Tomorrow

Just a quick reminder that tomorrow is a Fed Day. Over the last few years I've written an awful lot about Fed Days and market behavior on and around them. In general, Fed Days have been bullish, though there are certain nuances that substantially affect the edges. For those that may want to review some of the edges I have identified, you can check out the Fed Day label on the right hand side of the blog, or use the link below:

http://quantifiableedges.blogspot.com/search/label/Fed%20Study

Of course the most complete collection of my Fed Day studies is contained in the Quantifiable Edges Guide to Fed Days. For more information on the book/ebook, check out the link below:

http://www.quantifiableedges.com/fedguide

http://quantifiableedges.blogspot.com/search/label/Fed%20Study

Of course the most complete collection of my Fed Day studies is contained in the Quantifiable Edges Guide to Fed Days. For more information on the book/ebook, check out the link below:

http://www.quantifiableedges.com/fedguide

Monday, November 1, 2010

1st Day of November Tendency

I've discussed before how the 1st day of the month tends to have a bullish bias. This has been the case since the late 80s. (Perhaps due to the rise in popularity of the 401k.) In July 2009 I looked back to 1987 and broke down the 1st day returns by month.

For whatever reason, the 1st trading day of November has shown a positive bias for a bit longer than most months. Below are the results looking back to 1978.

For whatever reason, the 1st trading day of November has shown a positive bias for a bit longer than most months. Below are the results looking back to 1978.

Friday, October 29, 2010

A Rare Consolidation

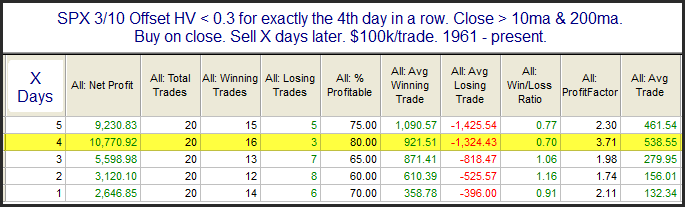

On Tuesday I discussed the 3/10 Offset HV indicator. I used it to measure when a market has become so coiled that is is likely to have a sharp move. We have a very unusual situation right now in that the 3/10 Offset HV has closed at a very low level for 4 days in a row. I decided to run a test last night to look at other times SPX’s 3/10 Offset HV closed below 0.3 for 4 days in a row. I also filtered using the short and long-term trend. Results are below.

These results would seem to suggest an upside edge. But I also looked deeper. Below is a listing of all 20 instances going back to 1960.

What I find most notable are the dates of the occurrences. As you can see most of the instances took place in the 60s and 70s. Also, this is the 1st instance in over 14 years. Personally, I’m not terribly comfortable using a study whose results are primarily achieved during the 60s and 70s and with no instances since ’96. Therefore I decided not to include it when formulating my outlook.

Many more studies lead to dead ends than lead to quantifiable edges. When deciding what to include in your analysis, it is important to be intellectually honest with yourself. Traders should look to trade aggressively when edges strongly suggest a bias. It is just as important to remain patient and conserve capital when evidence is mixed or lacking.

These results would seem to suggest an upside edge. But I also looked deeper. Below is a listing of all 20 instances going back to 1960.

What I find most notable are the dates of the occurrences. As you can see most of the instances took place in the 60s and 70s. Also, this is the 1st instance in over 14 years. Personally, I’m not terribly comfortable using a study whose results are primarily achieved during the 60s and 70s and with no instances since ’96. Therefore I decided not to include it when formulating my outlook.

Many more studies lead to dead ends than lead to quantifiable edges. When deciding what to include in your analysis, it is important to be intellectually honest with yourself. Traders should look to trade aggressively when edges strongly suggest a bias. It is just as important to remain patient and conserve capital when evidence is mixed or lacking.

Wednesday, October 27, 2010

VIX and SPX Both Close Higher for the 2nd Day in a Row

The SPX and the VIX typically move in opposite directions. It is somewhat unusual to see them both move higher on the same day. It is especially unusual to see this happen 2 days in a row as we saw on Monday and Tuesday. Below is a study that looks SPX performance following such occurrences. It only considers those instances that occurred when the SPX was trading above its 200ma.

Instances are a bit low but the stats seem to suggest a possible downside edge over the next 1-3 days.

Instances are a bit low but the stats seem to suggest a possible downside edge over the next 1-3 days.

Tuesday, October 26, 2010

Volatility Contraction & A Study In Memory of Bruce Hanna

Notable about current action is that the 3/10 Offset HV Indicator has fallen into “extremely low” territory. I first introduced this indicator in the July 13, 2009 blog. It looks at the historical volatility over the last 3 days versus the historical volatility over the previous 10. Low readings in this indicator occur when there has been a sharp contraction in volatility. In that blog post I showed that these sharp contractions are typically followed by volatility expansions.

About a year ago I wrote a detailed study that examined using the 3/10 Offset HV Indicator as a filter for daytrading Opening Range Breakouts. The study is 5 and a half pages in length. I’ve never offered it through the blog before. It is only available in the members section of the Quantifiable Edges site.

I took the last week off from blogging after my father passed away. He got dementia at a young age and it took him away from us much too soon. In his memory a fund has been set up with the Alzheimer’s Association.

If you use the link below to make a donation to the Alzheimer’s Association I will happily forward you a copy of the Quantifiable Edges Opening Range Breakout (ORB) Study. The donation may be in any amount. I would ask that if you have found the blog helpful in your trading over the years that you consider a generous (tax-deductable) donation.

http://act.alz.org/site/TR?pxfid=27370&pg=fund&fr_id=1060

I will receive notification from the Alzheimer’s Association when a donation has been made, along with the person’s email. With this information I will forward a link to the Quantifiable Edges Opening Range Breakouts Study along asap. If you do not get it within a few hours, please email me at ORBstudy @ quantifiableedges. Com (no spaces) and let me know. I apologize for not being able to automate the entire process.

About the Alzheimer’s Association (from their website):

The Alzheimer's Association is the leading, global voluntary health organization in Alzheimer care and support, and the largest private, nonprofit funder of Alzheimer research.

More information may be found directly from their home page.

http://www.alz.org/index.asp

Thanks,

Rob

About a year ago I wrote a detailed study that examined using the 3/10 Offset HV Indicator as a filter for daytrading Opening Range Breakouts. The study is 5 and a half pages in length. I’ve never offered it through the blog before. It is only available in the members section of the Quantifiable Edges site.

I took the last week off from blogging after my father passed away. He got dementia at a young age and it took him away from us much too soon. In his memory a fund has been set up with the Alzheimer’s Association.

If you use the link below to make a donation to the Alzheimer’s Association I will happily forward you a copy of the Quantifiable Edges Opening Range Breakout (ORB) Study. The donation may be in any amount. I would ask that if you have found the blog helpful in your trading over the years that you consider a generous (tax-deductable) donation.

http://act.alz.org/site/TR?pxfid=27370&pg=fund&fr_id=1060

I will receive notification from the Alzheimer’s Association when a donation has been made, along with the person’s email. With this information I will forward a link to the Quantifiable Edges Opening Range Breakouts Study along asap. If you do not get it within a few hours, please email me at ORBstudy @ quantifiableedges. Com (no spaces) and let me know. I apologize for not being able to automate the entire process.

About the Alzheimer’s Association (from their website):

The Alzheimer's Association is the leading, global voluntary health organization in Alzheimer care and support, and the largest private, nonprofit funder of Alzheimer research.

More information may be found directly from their home page.

http://www.alz.org/index.asp

Thanks,

Rob

Monday, October 18, 2010

Wednesday, October 13, 2010

Modest Gaps Higher From High Levels

I've shown several times before that when the market is already at a high level and it gaps up large in the mornining there is a quantifiable downside edge for the rest of the day. The large gap up incites profit taking. See the link below for an example:

http://quantifiableedges.blogspot.com/2009/08/large-gaps-up-from-1-month-high.html

But what of times like now when the makret is at a new high, but the gap up is only modest? Below is one way to look at it.

It appears when the gap up is of a moderate size a downside edge no longer exists. And while a large gap up would have had me excited about shorting this morning, this study suggests no substantial edge at all.

http://quantifiableedges.blogspot.com/2009/08/large-gaps-up-from-1-month-high.html

But what of times like now when the makret is at a new high, but the gap up is only modest? Below is one way to look at it.

It appears when the gap up is of a moderate size a downside edge no longer exists. And while a large gap up would have had me excited about shorting this morning, this study suggests no substantial edge at all.

Tuesday, October 12, 2010

Low VIX:VXV Ratio At A 50-day High

I've found in the past that a very low VIX:VXV ratio can often be a bearish indication for the market. Monday we saw the ration drop sharply and the SPX close at a 50-day high. Below is a study that examines a low VIX:VXV ratio and market at a new high.

Implications appear to be mildly bearish, but are mostly exhausted after just 2 days.

Implications appear to be mildly bearish, but are mostly exhausted after just 2 days.

Friday, October 8, 2010

Happy Columbus Day?

While the stock market is open on Monday, banks, schools, government offices, and the bond market are closed. In past years with the bond market closed, the stock market has done quite well on Columbus Day. Of course the most famous Columbus Day rally was in 2008 when the market gained over 11% after having crashed the week before. This year circumstances are much different and the market has put in some nice gains this week. In the Subscriber Letter last year I showed research that suggested an up week prior to Columbus Day typically made for a good Columbus Day. Below I have updated some of that research.

I’ve circled some of the more impressive stats here. With more than 7 out 0f 10 trades profitable and winners nearly twice the size of losers risk/reward has been very favorable. It appears positive momentum from the prior week has shown a fairly strong tendency to follow through on Columbus Day. Below is the profit curve.

We see a fairly steady upslope here. Combined with the stats above I’d say Columbus Day does appear to provide a solid seasonal edge. Happy Columbus Day!

I’ve circled some of the more impressive stats here. With more than 7 out 0f 10 trades profitable and winners nearly twice the size of losers risk/reward has been very favorable. It appears positive momentum from the prior week has shown a fairly strong tendency to follow through on Columbus Day. Below is the profit curve.

We see a fairly steady upslope here. Combined with the stats above I’d say Columbus Day does appear to provide a solid seasonal edge. Happy Columbus Day!

Wednesday, October 6, 2010

Quantifiying how Market Analysis can Enhance Individual Stock and ETF Trading Methods

Stock traders are aware that it is generally beneficial to have the market on your side. Whether the market moves up or down will often have an influence on an individual stock or ETFs movement. As they say, a rising tide will lift all boats. Yet too often traders (especially short-term traders) either ignore the general market action or underemphasize it in their decision making. They’ll look for a trigger without carefully considering the likely direction of the market.

I have found trading with the general market on my side to be of great importance. In August I conducted a study for my gold subscribers that demonstrated and quantified this concept.

As part of their gold subscription, traders have access to 11 different swing trading systems. On the system pages they are able to see the rules, Tradestation code, and backtest results across 2 lists of securities. One list is the S&P 100 and the other is a list of about 100 ETFs. The ETF list looks just at equity ETFs. It does not include any inverse or leveraged ETFs and there are no duplicates in coverage (like SPY & IVV). Most of the systems were first published within a few months of the subscriber letter first being published over 2 ½ years ago. When updating all the original backtests in late August I decided to see how the system performed when there was a perceived market edge versus times there wasn’t.

Many readers are aware of my Aggregator tool. The Aggregator utilizes the market studies I publish in the subscriber letter (and sometimes in the blog). It uses them to generate short-term market projections. Aggregator configurations can produce a long, short, or flat bias. A more detailed description of the Aggregator can be found here. A post describing how the Aggregator has been used as a system can be found here. The bottom line is that the Aggregator is my #1 tool for setting my short-term market bias. It also has a history dating back to the inception of the subscriber letter so I can easily see what my bias was going in to any given day.

So to quantify the value of trading with the market on my side, I ran tests on all 11 numbered systems to show their performance over the last 2 ½ years. I filtered the results to show trades that were accompanied by a confirming Aggregator signal versus trades with a neutral or offsetting Aggregator signal. In general I found results to strongly favor entering trades at times when there was also a perceived market edge (confirming Aggregator signal). Below is a partial example of the results that are shown on the website. This is “System 80509”. It looks to enter long trades in strongly oversold securities.

The discrepancy here is more substantial than was seen in many of the results. Still, the general results suggested you are much better off trading with the market winds at your back.

The lesson here is not that you need to utilize Quantifiable Edges systems or the Aggregator tool to enhance your results. It does mean that whatever trading methodologies you are using, you will likely stand a much better chance of success if you also incorporate some solid market analysis as a filter.

One last note for advanced system developers and testers. Complete historical Aggregator values are available with a QE subscription. You could easily download and apply them as a filter to test the effect on any of your own systems.

I have found trading with the general market on my side to be of great importance. In August I conducted a study for my gold subscribers that demonstrated and quantified this concept.

As part of their gold subscription, traders have access to 11 different swing trading systems. On the system pages they are able to see the rules, Tradestation code, and backtest results across 2 lists of securities. One list is the S&P 100 and the other is a list of about 100 ETFs. The ETF list looks just at equity ETFs. It does not include any inverse or leveraged ETFs and there are no duplicates in coverage (like SPY & IVV). Most of the systems were first published within a few months of the subscriber letter first being published over 2 ½ years ago. When updating all the original backtests in late August I decided to see how the system performed when there was a perceived market edge versus times there wasn’t.

Many readers are aware of my Aggregator tool. The Aggregator utilizes the market studies I publish in the subscriber letter (and sometimes in the blog). It uses them to generate short-term market projections. Aggregator configurations can produce a long, short, or flat bias. A more detailed description of the Aggregator can be found here. A post describing how the Aggregator has been used as a system can be found here. The bottom line is that the Aggregator is my #1 tool for setting my short-term market bias. It also has a history dating back to the inception of the subscriber letter so I can easily see what my bias was going in to any given day.

So to quantify the value of trading with the market on my side, I ran tests on all 11 numbered systems to show their performance over the last 2 ½ years. I filtered the results to show trades that were accompanied by a confirming Aggregator signal versus trades with a neutral or offsetting Aggregator signal. In general I found results to strongly favor entering trades at times when there was also a perceived market edge (confirming Aggregator signal). Below is a partial example of the results that are shown on the website. This is “System 80509”. It looks to enter long trades in strongly oversold securities.

The discrepancy here is more substantial than was seen in many of the results. Still, the general results suggested you are much better off trading with the market winds at your back.

The lesson here is not that you need to utilize Quantifiable Edges systems or the Aggregator tool to enhance your results. It does mean that whatever trading methodologies you are using, you will likely stand a much better chance of success if you also incorporate some solid market analysis as a filter.

One last note for advanced system developers and testers. Complete historical Aggregator values are available with a QE subscription. You could easily download and apply them as a filter to test the effect on any of your own systems.

Friday, October 1, 2010

Two Days Down to Finish a Quarter

It's a bit unusual to see the market decline the last 2 days of a quarter. Below is a study that looks at other times this has happened.

In the past the market has frequently seen a rally following a weak finish to a quarter.

In the past the market has frequently seen a rally following a weak finish to a quarter.

Tuesday, September 28, 2010

An Indicator Suggesting A Pullback for the NDX

Some indicators I haven’t discussed in a while are the Quantifiable Edges Volume Spyx indicators. The charts are found on the top of the charts page every night. The calculation for Spyx is proprietary, but basically it looks at volume on a relative basis across multiple securities. When Spyx levels post extremely high readings it suggests an upside edge over the short-term. Extremely low levels suggest a downside edge. Moves below 0 or above 100 are especially suggestive. Monday we saw the Nasdaq Volume Spyx come in between -3 and -4. Below is one of several studies from last night's Susbcriber Letter related to this low reading. It shows what happens when an extremely low Spyx reading occurs while the market is making a short-term high.

Results here are strong and consistent. Very low Spyx levels when the market is posting new highs have been greatly suggestive of a pullback in the past. Spyx readings can be found every night in the Quantifiable Edges members section. Gold subscribers may also download full histories of both S&P and Nasdaq Spyx. Files are updated each night.

Results here are strong and consistent. Very low Spyx levels when the market is posting new highs have been greatly suggestive of a pullback in the past. Spyx readings can be found every night in the Quantifiable Edges members section. Gold subscribers may also download full histories of both S&P and Nasdaq Spyx. Files are updated each night.

Monday, September 27, 2010

Large Gap-n-Go Formations to New Highs Revisited

Friday saw the SPY gap up strongly and then never look back. The gap never filled and it closed well above the open. In the 10/15/09 blog I looked at these type of situations when the market also made a 50-day high. I’ve updated that study below.

Instances are low here but the results are strong enough for me to take them under consideration.

Edit: This post appears not to have made it out at the desired time (almost a day late to my RSS feed). I am using a new blogspot editor and will look into what may have caused this. Apologies.

Instances are low here but the results are strong enough for me to take them under consideration.

Edit: This post appears not to have made it out at the desired time (almost a day late to my RSS feed). I am using a new blogspot editor and will look into what may have caused this. Apologies.

Friday, September 24, 2010

Declines On & After Fed Days

Historically Fed Days have generally had an upside bias. Often when the market closes down on a Fed Day it will bounce soon after. This week we have seen a down Fed Day (Tuesday) followed by 2 more days of selling. I looked at this situation in last night's subscriber letter.

While instances are low, there appears to be a decent upside edge. This is especially true on day 1. I discussed some more details in the letter. Those that wish to take a free trial may do so at any time. Here is a link to the free trial. Those who are already registered but would like to do so again may simply send me an email. As long as it has been 6 months since your last trial, you are all set.

While instances are low, there appears to be a decent upside edge. This is especially true on day 1. I discussed some more details in the letter. Those that wish to take a free trial may do so at any time. Here is a link to the free trial. Those who are already registered but would like to do so again may simply send me an email. As long as it has been 6 months since your last trial, you are all set.

Tuesday, September 21, 2010

Strong Breadth on the Breakout

It is very rare to see a fresh breakout occur on such positive breadth as we saw Monday. In the past it has often led to a successful breakout. Below is a study that examines this.

A positive impact can be seen right away. And when looking out 4-5 weeks the risk/reward remains very favorable. The market is certainly very overbought and could pull back at any time. But this is one study suggesting there's a good chance the current momentum begets more buying.

A positive impact can be seen right away. And when looking out 4-5 weeks the risk/reward remains very favorable. The market is certainly very overbought and could pull back at any time. But this is one study suggesting there's a good chance the current momentum begets more buying.

Monday, September 20, 2010

When the SPX and VIX Both Rise on a Friday

There was some unusual action in the VIX on Friday. As many traders are aware, it typically trades counter to the S&P 500. So on days the SPX finishes up the VIX will normally close down. I have shown several times in the past that there are often bearish implications when both the SPX and VIX rise on the same day. One quirk of the VIX is that it has a natural tendency to fall on Friday afternoons and then rise on Monday mornings. So while it is unusual to see both the SPX and VIX rise on the same day, it is especially unusual to see it happen on a Friday. I looked at this scenario last night.

In last night's Subscriber Letter I broke down the results a little further by filtering on the long-term SPX trend. I found that while downtrending reactions were more exagerated, occurances during an uptrend were still quite reliable.

In last night's Subscriber Letter I broke down the results a little further by filtering on the long-term SPX trend. I found that while downtrending reactions were more exagerated, occurances during an uptrend were still quite reliable.

Wednesday, September 15, 2010

Testing Tuesday's Outside Bar

I found it interesting that the SPY put in an outside day and closed down after closing at a short-term high Monday. Outside reversal bars such as Tuesday's are often viewed as bearish by many traders. I ran a study to examine the potential significance of this kind of bar.

Results here are similar to other studies I’ve run on outside day or key reversal bars in the past. It is often followed by a few days of weakness but it rarely marks the kind of significant top it is renowned for.

Recall though that Monday's study did suggest the possibility of an intermediate-term top, so it is a possibility. In any case, a few days of weakness here would be typical.

Results here are similar to other studies I’ve run on outside day or key reversal bars in the past. It is often followed by a few days of weakness but it rarely marks the kind of significant top it is renowned for.

Recall though that Monday's study did suggest the possibility of an intermediate-term top, so it is a possibility. In any case, a few days of weakness here would be typical.

Monday, September 13, 2010

Very Low Volume & Range Often Make For A Bearish Combination

In general very low volume and range when the market is not above its 200ma will lead to a pullback. I showed several studies along these lines in the subscriber letter this weekend. One with both short and intermediate-term implications is below.